French novelist Jean-Baptist Alphonse Karr (1808-1890) had a great quote that seems appropriate given the sequestration talks going on in Washington this week: “Uncertainty is the worst of all evils until the moment when reality makes us regret uncertainty.”

The sequestration – the mandatory budget cuts set to take effect this week – is causing more than a little uncertainty in the market. Some say the cuts are necessary to curb our ballooning debt; others feel they will be an unnecessary constraint to growth.

Fed chairman Ben Bernanke is in the second camp. He is urging lawmakers to not allow the cuts to happen, saying they will threaten the economic recovery.

Whichever side of the debate you are on, one thing is clear – U.S. national debt is growing into a bigger and bigger problem by the day. This is the reality that will eventually make us all "regret uncertainty" if it's not addressed.

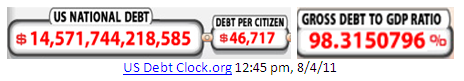

Case in point: in 2011 I wrote an article that included an image (shown below) of the U.S. national debt. According to the debt clock, on August 4th, 2011 the U.S. national debt stood at $14.57 trillion, or 98.3% of GDP.

Earlier this week I checked back in on the debt clock. Not that it will come as a surprise, but the U.S. debt burden has indeed grown. It now stands at $16.58 trillion, or 106% of GDP.

While the national debt has grown by nearly 14% over the past 18 months to surpass GDP by 6%, what's more troubling on a personal level is the 12.6% rise in debt per citizen, which now stands at $52,582.

This is the number that really hits home because it shows just how much every American citizen, including retirees and kids, is accountable for. If you want to look at just the taxpayer burden to get a better sense of “working age” debt load, the number is $146,612.

As I stated earlier, the main argument against the sequestration (and continually raising the debt threshold) is that the spending cuts will hurt growth, and therefore the stock market. However, breaking this down to an individual level, I think most of us would agree that trimming capital gains a few points might be better then amassing more debt, right? After all, it is net worth (or assets minus liabilities) that matters most at the end of the day.

So out of curiosity, I decided to compare the returns of the S&P 500 over the same period as my debt clock analysis. By this measure, index investors are indeed ahead of the game – the S&P 500 is up 24% versus a 14% rise in the national debt. On the downside, the national debt won't go away overnight, whereas a sharp market reversal could easily wipe out those stock gains in a short time.

The wealth effect of a rising stock market might make us feel richer, but in terms of net worth – remember the debt clock above – that sensation might prove to be fleeting.

You can't do much to alter the course of the debt clock. But you do have control over your own finances. Given the push and pull in Washington – and the potentially significant impact that spending cuts and/or debt ceiling raises could have on the market – I believe it's wise to assess your own net worth, and consider immediate action to protect it.

This doesn’t have to be dramatic. In my family's case, we've recently decided to book some gains in the market and pay down debt, mainly on assets. The wealth effect of this decision is real, and will help us to save money and increase our net worth with every additional debt payment.

Take a look at your net worth and see if you like your reality. Now may be a good time to take action if you're ahead of the game in the stock market.

Good Investing,

Tyler Laundon, MBA

Editor's note: If you would like to learn how you can bank steady gains with well-timed investments in stocks that are ready to run… then consider taking a free, 30-day trial to our growth stock service, Small Cap Investor PRO. You'll discover exactly how we're earning exceptional returns and get instant access to every special report and investment recommendation. Click here to try Small Cap Investor PRO, free.

Facebook

Facebook

Twitter

Twitter