In a moment, I am going to tell you how to take advantage of one of best investments for the foreseeable future. But first I want to you to take heed to what I am about to tell you.

With a market rally like this, you owe it to yourself to take precautions. No market rises forever. So today I’m going to tell you a way to protect yourself from the likelihood that this market rally won’t continue indefinitely.

But first, some context …

The Standard & Poor’s 500 Index (SPY) is up 16.8%. That’s the best start to a year since 1987, when it rose 18.7% during the comparable period. Later that year on October 19th, the Dow lost 508 points, or 22.6%, in the historic crash known as Black Monday.

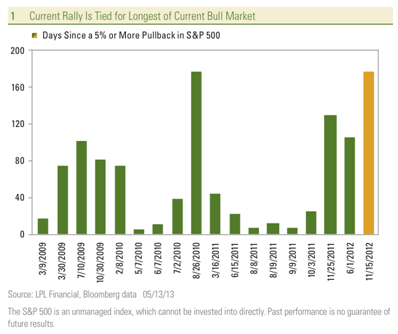

Moreover, it’s been 184 days since a daily 5% pullback in the S&P 500. The return for the market benchmark during this overwhelmingly bullish six months is 22.3%.

But it was the latest three-week spike higher in SPY made me realize the journey higher was nearly complete.

Roughly three weeks ago, SPY was trading for $153. Since that short time, the index has managed to tack on 8%. That’s pretty remarkable, considering the historical annual average return for SPY is approximately 8% a year.

The historic move has had a side-effect as well. It’s impacted the success of high-probability credit spreads over the past several months.

But before I get to the side-effect let me give you a brief insight into one of my favorite investment strategies. Other than selling puts, credit spreads offer the highest-probability strategy in the investment world. We’re talking about making investments with an 85% chance of success. Credit spread strategies are THE choice amongst professional investors, particularly professional options traders. The strategy allows you to make money in a up, down or sideways market in less than 45 days. As a result, it is one of the best ways to bring in monthly income and why I use the strategy, among others, in my Options Advantage service.

Unfortunately, we have been in one of weakest periods for credit spreads over the past 30 years. A sharply trending market coupled with historically low volatility is the one extreme credit spreads have a hard time handling. However, the most profitable periods have followed these weak periods…and I expect to see history repeat itself once agin this year.

Fortunately, this historic period is an anomaly, so the chance (or probability as I like to say) of the upward trend continuing is low. Unfortunately, it’s the anomalies that are a detriment to high-probability credit spread strategies.

But as we all know, it’s the weak periods that lead to historic returns.

This leads me to the investment I mentioned at the beginning of the article. I recently put together a webinar on what I call “The 77% Income Trade”. Within the presentation I discuss the strategies I use to bring in income on a monthly basis. But more importantly, I give away two actionable investments that should do well over the next 35 days.

Also, if you haven’t had a chance sign-up for my free weekly newsletter, The Strike Price….and if you want to know what I am thinking on a daily basis check out my Twitter feed.

Kindest,

Andy Crowder

Editor’s Note: If you would like to learn more about options and how you can generate steady income month in and month out… then consider taking a free, 30-day trial to our real money alert service, Options Advantage. You’ll discover exactly how our resident options expert, Andy Crowder, is using high probability trades to steadily grow a $25,000 real money portfolio. Every trade is executed for real… and readers are alerted instantly, so they can invest right alongside Andy. Click here to try Options Advantage, free.

The Real Story Behind this Market Rally

by Ian Wyatt

Facebook

Facebook

Twitter

Twitter