You’ll never hear me recommend buying shares of a richly priced stock.

That’s because my cardinal rule as a value investor is to buy undervalued stocks. I know that if I’m buying a stock well below its true value, I’m getting a bargain. It’s a strategy that creates meaningful upside, even if the company’s performance falls short of my expectations.

While I never buy overvalued stocks, I don’t mind owning richly priced stocks. It might seem like a contradiction… but it’s not. Let’s use a well-known stock to show the difference…

When I bought Netflix (Nasdaq: NFLX) in December 2011 shares were deeply depressed, trading in the $70s. The stock had fallen from $300 in a matter of months, and the market value of the company had dipped to just $4 billion.

Some readers thought I was crazy when I recommended the stock in my issue of $100k Portfolio, titled, “Buying the World’s Stupidest Company”.

Shortly after my recommendation, shares quickly rallied … and then crashed back to $70 on a quarterly earnings shortfall. So, in May 2012, I sent this dispatch to my readers:

“When great companies are selling at a discount, it’s time to buy more. Netflix was a great buy back in December 2011 at $73 per share. Today, the market has decided to give us a second opportunity to buy more stock at the same price. The fundamentals of the business have improved.

“In my opinion, buying Netflix below $80 a share is one of the best investments available to investors today. With the stock market up considerably in recent years – and thus far in 2012 – there aren’t a lot of values available to investors. Netflix appears to be one of the better values that I’ve seen in a while.”

Since then, shares of Netflix have taken off. In January, I sold some of my Netflix shares in my real-money $100k Portfolio account. I cashed in 25% of my stock at a 130% profit, and also sold one call option at a 284% gain. At that time, Netflix shares traded at $163. (You can read all the details in How I Profited 130% on This Game Changing Technology Stock).

Shares have since risen even more. The stock now trades at a mind-blowing 180-times this year’s expected earnings. But I continued to hold a large position in the stock, despite the big profits and the very rich valuation.

The reason was simple. Richly priced and overvalued stocks can defy gravity and continue to rise for prolonged periods of time. When a stock is hot and investors are clamoring to buy shares, the price can continue to rise and sustain lofty valuation multiples. Selling too early may lock in gains, but it also limits the profits.

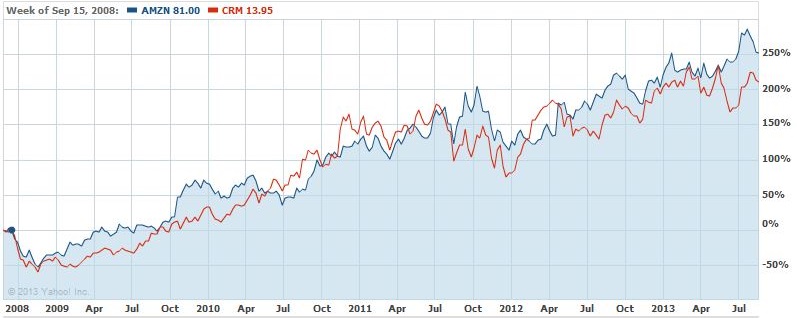

Netflix is not unique. Just look at Amazon (NASDAQ: AMZN) and SalesForce (NYSE: CRM) – two huge growth stocks that have been trading at more than 100-times earnings for years. Despite that, the share prices of both have soared 200-250% over the last five years.

Amazon & SalesForce:

Proof That Even Overvalued Stocks Can Soar for Years

I would never buy a stock like Netflix at its current valuation. However, I know that this particular stock could continue to soar for years to come.

By selling a little bit of my stock, I’ve locked in some profits and protected my capital. But by “letting it ride” and holding onto some of my stock, I’m continuing to profit as more investors pile in.

With Netflix shares now at $269, my original position is now up 268%. I’m unlikely to call a top on Netflix when I eventually sell the stock.

But I know that over the years, I’ve made a lot more money holding onto my winners rather than cashing in on my early profits. And that’s a strategy that I’ll continue to use, even when a stock becomes grossly overvalued.

Full Disclosure: Ian Wyatt’s $100k Portfolio is an investment newsletter with a real-money portfolio. In that account and a personal account, I own shares of Netflix. Transactions were made according to the guidelines of our Trading Compliance Policy.

Facebook

Facebook

Twitter

Twitter