Earnings used to be the primary driver of stock prices. As earnings go, stock prices were sure to follow.

That's no longer the case. To be sure, earnings matter. But today there is a disconnect between earnings and stock prices.

Earnings growth has been "OK," but has slowed each successive quarter. At the beginning of the year, estimates for second-quarter earnings growth hovered near 5%. Third-quarter earnings growth was expected to come in higher – near 8%.

Today, Zacks Investment Research expects S&P 500 earnings growth for the third quarter 2013 to come in at 1.1%. Of the 460 companies that have reported for the second quarter, average earnings growth was been only 2.1%.

More companies have guided earnings lower in recent months, prompting analysts to cut estimates for subsequent quarters. At the same time, the S&P 500 index has moved to record highs.

Year-to-date, the S&P is up 17.5%, and it appears expensive. The Shiller P/E multiple – an inflation-adjusted earnings average for the past 10 years – is up to 23.9, a multi-year high. (The long-term average Shiller P/E multiple is 16.5; the median is 15.9.)

So, we have slowing earnings growth and rising stock prices. How can this be?

Look to the Federal Reserve. Never in its 100-year history has the Fed been so influential to asset values and so manipulative of markets. Then again, never before has the Fed been so zealous in buying assets and injecting money into the financial system.

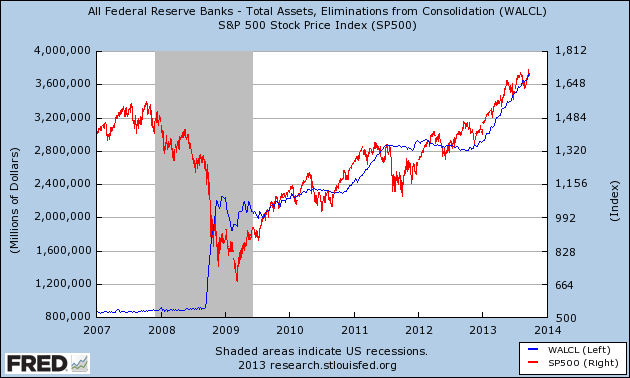

Through quantitative easing – purchasing Treasurys and mortgage-backed securities – the Fed has injected a massive amount of new money into the economy. The graph below reveals how much of that money has found its way into the stock market.

The blue line is assets on the Fed's balance sheet; the red line is the price of the S&P 500. The correlation between the two since 2009 is undeniable.

For much of September, the stock market was aflutter over Fed tapering – the notion it would reduce its monthly purchases of notes and bonds. Nearly every Wall Street pundit was expecting the Fed to taper. When the Fed announced no tapering would occur, the S&P 500 soared to new highs, even though earnings estimates were being continually lowered.

Stock-market participants, in short, have become addicted to the Fed's monetary inflation.

They are also addicted to a corollary of new-money creation – ultra-low interest rates. The Fed's demand for notes, bonds and mortgage-backed securities keeps yields on debt low. This further drives demand for stocks, as more investors turn to equities for income and yield.

You might ask, why should I care about the Fed's inflationary monetary policy as long as stock prices keep rising?

For one, manipulation is unsustainable. If the Fed continues to inject new money at the going rate of $85 billion a month, we'll end up with Wiemar Republic Germany inflation and an economic collapse.

More basic than that, the risk of a stock-market bust is imminently raised: The longer a rally is sustained, the more likely it is to succumb to a punishing sell-off.

Economist Hyman Minsky, in his Financial Instability Hypothesis, showed that over a protracted period of rising asset values, economies tend to move from a stable structure to speculative finance and Ponzi schemes. Given the rise in all the major stock market barometers that's unsupported by earnings growth, I see a rise in speculating and scheming.

I'm still invested in stocks, because there are so few worthwhile alternatives for income investors. But I'm more vigilant and selective today than I've been in the past four years. I suggest you be the same.

Facebook

Facebook

Twitter

Twitter