Many investors think the secret to achieving big returns in the stock market is to simply invest in great companies.

Unfortunately, that’s not always the case. There are thousands of great companies out there with great products, solid earnings, top-notch customer service and exceptional managers. But not all of these companies deliver big returns to shareholders.

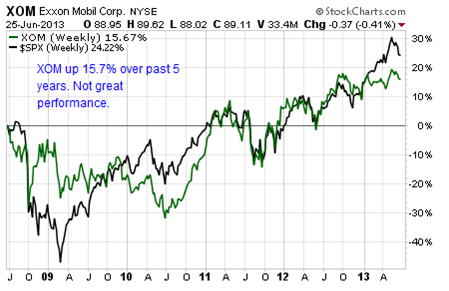

For example, take Exxon Mobil (NYSE: XOM), the dominant company in its industry. The stock is up just 15.7% over the past five years. That’s not great performance, especially considering the S&P 500 is up 24.2% over the same time period.

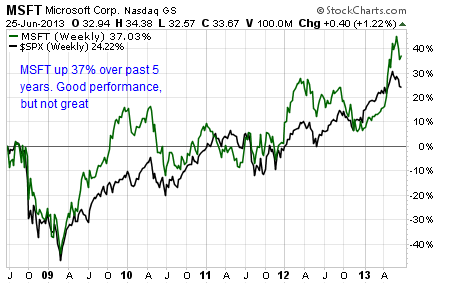

Or look at Microsoft (NASDAQ: MSFT), which dominates the software industry. It’s a great company – and was once a great investment. The stock is up 37% over the past five years, which is good … but not great.

The reality is that there is a difference between great companies and great investments. And almost all great investments share one thing in common … positive catalysts.

A stock catalyst is an event that has a very sudden and dramatic impact on the company’s future. They can completely change a company’s growth profile and cause a rush of investors into the stock, driving the share price higher by 100% or more over a relatively short period of time.

Sometimes it takes six to 18 months, depending on the circumstances. Sometimes it happens overnight.

Take a look at one example of a great company that has also been a great investment and you’ll see exactly what I mean. The company is Susser Holdings (NYSE:SUSS), a chain of convenience stores and gas stations based in Texas.

In 2011 I caught wind of what Susser was doing to grow their business. It wasn’t complicated (at least on the surface – I don’t want to diminish the hard work of Susser’s employees), but it was extremely effective. In short, Susser was doing three things that would act as major catalysts for the stock price.

First, it was building stores at a rapid rate of 20 to 30 per year.

Second, it was building bigger stores that generated two to three times the cash flow of smaller stores.

And third, it was serving a new market by including fast-serve Mexican-style food in its new stores.

Combined, these three catalysts powered strong and steady revenue growth that averaged more than 16% annually over the last 5 years. And more importantly, the expansion allowed profits to flow freely; Susser grew earnings per share from just $0.12 in 2009 to $2.19 in 2012.

These catalysts were reflected in Susser’s share price, which rallied from just $10.00 in 2009 to $47.40 today, a rise of more than 360%.

That’s great performance that you just won’t find with great companies – but not great investments – like Microsoft and Exxon Mobil.

A catalyst-based investing strategy can help investors find big winners before the run-up in the share price. And catalysts are happening around us every day, making stocks move. That’s why they are the most important events in the stock market – they determine whether or not a great company will become a great investment.

When you’re scoping out your next great investment idea, make sure to identify specific catalysts that have the potential to move the stock. And if you’d like help finding stocks and using catalyst-based investing strategies, take a look at our new investment advisory service, the 100% Letter.

Every two weeks I send subscribers new ideas – like Susser Holdings – that have multiple share price catalysts on the horizon.

I’d love to have you try the service and see if you think it’s a good investment. I just sent my latest research report to subscribers last night, so if you join today you’ll have a fresh idea to review that is hot off the printing press.

Good Investing,

Tyler Laundon, MBA

Facebook

Facebook

Twitter

Twitter