Today I’m going to tell you a personal story about how I learned the most important lesson of my investment career at a very early age.

The lesson is about the importance of compound interest, and how to use Dividend Reinvestment Plans for long-term profits.

It all started about 30 years ago when I was barely walking. You see, my grandfather made what was one of the most intelligent investments of his life.

My grandfather wasn’t wealthy. He was a salesman and stamp collector who turned that interest into a nice small business in New Jersey.

In the early 1980s when he had some extra money from a recent stamp sale, he decided to buy some shares of Exxon. He also decided to buy a few shares of stock for each of his seven grandchildren. His initial investment was tiny.

The smartest investment decision of his lifetime was buying Exxon shares in the early 1980s. He bought the stock at the right time. Why Exxon? Because the company was expanding, oil prices were rising, and the stock paid a healthy dividend.

Just as important, the company had a history of growing its dividend and paying its shareholders more cash every year.

His second smartest decision was to select the "Dividend Reinvestment Plan" option when he bought the stock. You see, he knew that neither he nor his grandchildren needed the dividend income right away. After all, he was still working and his grandchildren were all very young at the time.

Exxon went on to become the biggest and most profitable oil company in the world as the price of oil soared from $38 in 1980 up to recent high of $147 in 2008.

As a result, my grandfather’s initial investment, which was valued at only a few hundred dollars at the time of purchase, grew to over $10,000 in the early 1990s.

A large part of the profits from this investment came from the compounding capital gains year-after-year, and the growing size of the position through dollar cost averaging thanks to the Dividend Reinvestment Program.

Today, Dividend Reinvestment Programs are often referred to as DRIPs. Many impatient investors dismiss them as a boring way to invest. However, I’ve learned first-hand just how profitable these programs can be if an investor buys the right stock, reinvests the dividends, and sits tight for a decade or longer.

That’s why I advise those investors who want to collect safe and reliable dividends, but don’t need the income from those investments today, strongly consider DRIPs.

It might seem hard to believe, but after 10 or 20 years, the difference in value between a portfolio utilizing a dividend reinvestment program and one that doesn’t, is nothing short of remarkable.

So what makes a dividend reinvestment program such a smart decision for your portfolio?

Well, to start, a dividend reinvestment program allows anyone to buy shares directly from a company without paying brokerage fees. Over time, for an active investor, brokerage fees can really start to add up and ultimately cut into your principal and reduce your profits.

When you utilize a DRIP, you don’t have to worry about transaction fees reducing into your investment. And even better, you’re able to grow a greater amount of your investment through compound interest, which is quite possibly the most incredible wealth building secret ever discovered.

Albert Einstein even went as far as calling compound interest, "The 8th wonder of the world."

And I don’t know about you, but when one of the smartest men in the history of the world makes a statement like that, I pay attention. Compound interest lets you turn a small investment into a fortune in as little as 10 to 20 years.

Let me explain…

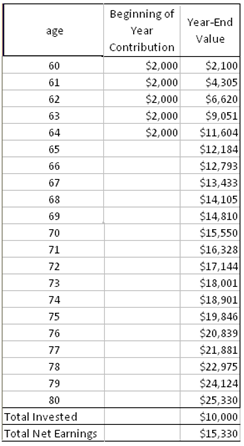

Based on a very realistic 5% dividend, by investing $2,000 a year over the next 5 years, in 20 years time you’ll have grown your $10,000 investment into $25,000.

Based on a very realistic 5% dividend, by investing $2,000 a year over the next 5 years, in 20 years time you’ll have grown your $10,000 investment into $25,000.

And if you double your investment to $4,000 a year… you’ll have $50,000 after 20 years!

Take a look at the table to the right and I think you’ll understand why DRIPS just makes good investing sense.

The bottom line is: Whether you’re 20 or 60 years old, or anywhere in between, DRIPS are a sure-fire way to start building your next egg or make up for setbacks your retirement fund may have suffered in recent years.

According to a study by the financial firm Legg Mason, reinvested dividends account for 41% of the total return of the stock market since 1871. That means that if you’re not reinvesting your dividends, you’re missing out on one of the easiest and surest ways of increasing your gains.

While DRIPs may seem like "boring" investments that take a while to pay- off, the long-term benefits of these investments are clear. Using a DRIP today is a low-cost way to build wealth through dividend paying stocks.

And when you get to the point in your life when you need a steady stream of income to fund your retirement, you’ll have a big chunk of stock paying a very healthy yield.

Facebook

Facebook

Twitter

Twitter