95% of all investors are making a huge mistake. They fail to take a few easy steps to insure their investments and protect their wealth.

Consider it this way: you buy homeowner’s insurance to protect the value of your home. You buy car insurance to protect you from a crash. You use insurance for just about every valuable asset you own – because it’s simply too risky to do without it.

Today, I want you to just consider a simple way you can protect your portfolio with a form of insurance – and even better – get paid along the way.

If income is your goal, you should strongly consider using this special form of insurance. Here’s why…

I’m talking about options – but for a minute, forget that I even mentioned the word. That’s because, at a basic level, options are just another form of insurance.

For instance, take covered calls, the safest and most recognized of all options selling strategies. The strategy is the only options selling strategy allowed in retirement accounts.

But why?

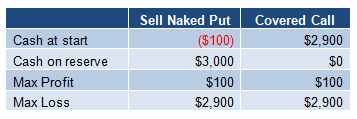

Selling a naked put is the same as selling a covered call. They have identical profit and loss profiles. So why can’t investors use them in retirement accounts?

Before I go any further, let me explain a little about naked puts. A "naked put" is an uncovered put option that you have sold. It is "uncovered" (or "naked") if you have not shorted an equivalent number of shares of the underlying stock. If the put option is assigned to you, then you will have the shares put to you at a price equal to the strike price per share.

We Like it Naked

Microsoft (NASDAQ: MSFT) shares are trading for $33.

You aren’t necessarily pleased with buying the tech giant at current prices. But you want to buy the stock at $30. So you decide to sell one naked put at the $30 strike price.

As a result, you immediately receive $100 in options premium. You’re essentially being paid to agree that if MSFT drops below $30, you will buy 100 shares at your desired price of $30. Since it cost you $3,000, and you earned a $100 premium, your total cost for 100 shares is $2,900. Or $29 per share.

The most you can make with a naked put is the amount you sold it for, in this case $100. As long as MSFT doesn’t move over 9.1% lower (below the short strike of $30) at the time the put option expires you keep the entire premium.

The most you can lose is the strike price per share minus the option premium you receive. So if you got $1 for that 30-strike put you sold, then your max loss is $29/share. If MSFT stock becomes worthless, you will have 100 shares put to you for $30/share, but you received $1/share in option premium when you sold the put. But what are the chances of MSFT going to zero?

How a Covered Call Would Work in the Same Case

Same scenario: MSFT is selling for $33 a share. You buy 100 shares and sell a 36 call for $1.

The most profit you can make is if MSFT stays below $36 on expiration day. You will make the amount of premium per share or $100. Same profit as in the naked put case.

The most you can lose is your net debit per share. Your net debit is the price you paid for the stock ($33) minus the amount you received for the call option ($1), or $29/share. If MSFT stock becomes worthless by expiration, you could lose $29 per share.

This is the exact same as in the naked put case.

As you can see above both are conservative, yet highly profitable, strategies for earning extra and instant payouts from the safest blue chip stocks like Microsoft and Wal-mart (NYSE: WMT).Earlier today, I published a brand new report to our website that details a unique way to earn what I call "60-Second Dividends". Within the report I discuss both naked puts and covered calls and how to use them in what I call an “income cycle”.

As one of my valued readers, I don't want you to miss out. Because you can’t sit on this…Click here to get your report.

Facebook

Facebook

Twitter

Twitter