Facebook (NASDAQ:FB) shares are currently trading at $27.

And yet, six of the most well-respected Wall Street analysts have a median target of $42 for the stock, with a high target of $48.

So how realistic are the professional analysts' price targets? Let me show you what the market actually expects.

Options nerd alert: How do I get these probabilities? It's easy. I take the delta of a certain strike price and cut it in half. Most savvy options brokers offer accurate "probability of touching" data as part of their software package.

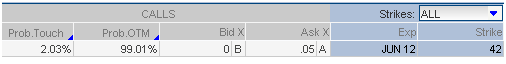

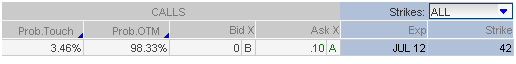

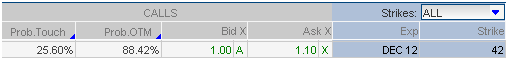

Basically, the “probability of touching” estimates the likelihood of the market reaching the strike price of an option prior to the expiration date. These numbers are displayed below over various timeframes: June, July, December and January 2014.

As you can see below, the probability of Facebook shares touching $42 in the next 7 days is 2.03%.

As for Facebook shares touching the high target of $48 – well, even over the next 588 days (January 2014 LEAP expiration date) the probability of touching is only 8%.

So as you can see, the probability of Facebook successfully reaching $42 over the course of the next year or so is not very high … at least according to current option prices. Yet most professional Wall Street analysts are predicting such a move with little regard for the statistics.

Why would you ever buy a stock based on an analyst's price target that has a chance of success of only 2%, 3% or even 30%? It's pure insanity.

Yet this is how the majority of investors allocate their money – blindly listening to Wall Street predictions that make little, if any, sense. Remember, just buying a stock gives you only a 50% chance of success …. a coin toss.

The reason why I focus on probabilities of success so much is because it is truly what investing is about. It is the edge that gives self-directed investors the ability to achieve far better results than their professional counterparts. It gives self-directed investors the ability to build wealth consistently over the long term in a more consistent, defined way.

One day I would love to hear an analyst on CNBC actually state that the reason they are predicting a stock to move to a certain price is because it has a probability of success that is actually greater than 50%.

Facebook

Facebook

Twitter

Twitter