Before I get into this week’s article, I have to tell you about a free event I’m holding next week. I’m holding a LIVE options webinar on February 6, and I’d like to give you a chance to sign up today. We have a limited number of seats available for this webinar, and as a valued reader, I want you to be able to take part.

I’ll discuss my two basic strategies for producing income – and I’ll field questions from the audience.

If you’ve ever had any questions and would like to talk with me personally, next Monday is your best chance.

Click here to get signed up before we run out of room.

OK, now onto my main topic.

Last week, I explained how to double your dividends with one simple strategy.

That strategy is covered calls.

I know, I know. Some of you aren’t interested in diving into the wonderful world of options. For some reason, self-directed investors seem to ignore what is, in my opinion, the best income strategy available to investors. As such, I feel it would be a mistake to not be exposed in some way to the covered-call strategy.

So let’s try another tack that uses options … but this time with a twist.

In order to take advantage of this options strategy, you DO NOT – I repeat, DO NOT – need to trade options. You can profit from covered calls with a regular old fund.

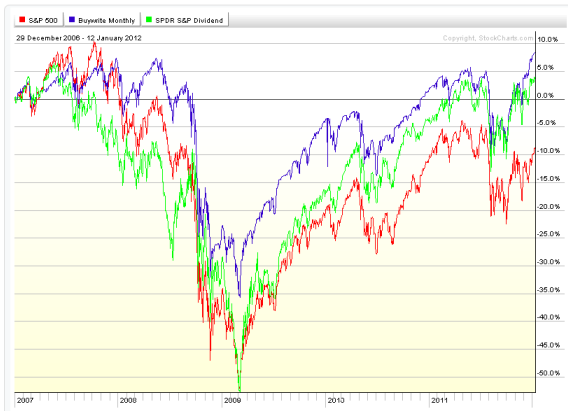

The following chart shows how a covered-call (also known as a buy-write) approach compares to a dividend strategy and the broader market. Just look at how the SPDR S&P 500 (SPX), CBOE S&P 500 BuyWrite Monthly Index (BXM) and the SPDR S&P Dividend ETF (SDY) have performed over the past five years.

It’s pretty clear that the buy-write method has produced the best results throughout most of the past five years.

So if you’d like to take advantage of covered calls without actually trading an option, here’s a look at a few different plays in the covered-call fund universe (all data sourced from Morningstar):

First up is one of my favorite funds: Nasdaq Premium Income & Growth Fund (Nasdaq:QQQX). This five-star Morningstar-rated fund has outperformed the major market benchmarks consistently since its inception in early 2007. QQQX attempts to mirror the Nasdaq 100 index, while also writing call options against the index. The Nasdaq 100 features the giants of the tech world – 15% of the fund’s holdings are in Apple (Nasdaq:AAPL), with Microsoft (Nasdaq:MSFT), Google (Nasdaq:GOOG), and Oracle (Nasdaq:ORCL) combining for another 21%.

A few other buy-write or covered-call funds are the Dow 30 Enhanced Premium and Income Fund (DPO), GAMCO Global Gold, Natural Resources, and Income Trust (GGN), BlackRock Enhanced Dividend Achievers Trust (BDJ) and Nuveen Equity Premium Opportunity Fund (JSN).

So again, why would any investor choose to shy away from such a proven income strategy that has outperformed the market and dividend-paying stocks over the long term?

Granted, the 2011 market was tailor-made for hedged strategies. In a strong bull market, buy-write strategies will drastically underperform the broader market.

But let’s face it – we’re in a prolonged secular bear market in stocks. To ignore this fact is to ignore the strongest trend going.

In a bear market, the income from call options – the majority of which will expire unexercised – will provide some downside protection and index outperformance. But note that this option income will not overcome steep losses in the underlying equities.

At its heart, the goal of a covered-call strategy is to lower our cost basis by generating income through the selling of call options while hedging against a pullback in the stock you own.

But now you don’t have to worry about the nuances of covered calls (when to sell premium, at what strike, etc.). You can just invest in one of the funds above and be exposed to one of the best income-based strategies available to self-directed investors.

As always, if you have any questions about covered calls or options in general please do not hesitate to email me at optionsadvantage@wyattresearch.com.

Andy Crowder

Editor and Chief Options Strategist

Options Advantage and The Strike Price

Facebook

Facebook

Twitter

Twitter