Editor’s note: Last month options analyst Andy Crowder hosted a live chat to discuss his “Two Easy Options Strategies for Generating Income in 2012.” The response was overwhelming – close to 400 of you tuned in for the hour-long chat, and many of you came equipped with some excellent questions for Andy. While Andy was able to get to many of those questions during the live chat, there were simply so many that he was not able to answer all of them. In today’s Daily Profit, Andy addresses some of your most pressing options questions that went unanswered during our webinar.

If you still have questions after today, there’s good news. Andy will be hosting another options live chat next Thursday, March 8 at 6 p.m. eastern. The new live chat is titled, “How to Make a Consistent 15% Every Six Weeks.” So click here to register for the FREE live chat event now!

If you still have questions after today, there’s good news. Andy will be hosting another options live chat next Thursday, March 8 at 6 p.m. eastern. The new live chat is titled, “How to Make a Consistent 15% Every Six Weeks.” So click here to register for the FREE live chat event now!

Until then, here are this week’s questions – and Andy’s answers.

What is your favorite strategy for producing income?

As an options trader, I am often asked about my favorite options strategy for producing income. I have been bombarded with questions from investors for years about how to trade small-cap stocks for income using options. In my opinion, the best way to bring in income from options on a regular basis is by selling vertical call spreads and vertical put spreads, otherwise known as credit spreads.

Credit spreads allow you to take advantage of theta (time decay) without having to choose a direction on the underlying stock. This is great when you aren’t 100% confident in the mid-term direction of say, an ETF.

Vertical spreads are simple to apply and analyze. But the greatest asset of a vertical spread is that it allows you to choose your probability of success for each and every trade. And in every instance, vertical spreads have a limited risk, but also limited rewards.

My favorite aspect of selling vertical spreads is that I can be completely wrong on my assumption and still make a profit. Most people are unaware of this advantage that vertical spreads offer.

Can you explain your process for choosing trades in your income-producing strategy?

Great question – and one that I will be discussing at length in my upcoming webinar.

First, I look for efficient markets. Professional options traders know that there are only 80-100 products (ETFs and stocks) out there that offer efficient markets. For clarification, I define an efficient market by a tight bid-ask spread. Click here to read my recent article about tight bid-ask spreads.

Next, I watch for overbought/oversold extremes within my short list of ETFs that I follow. I use the RSI over different timeframes to compare an entity’s performance to itself over a period of time. RSI allows me to gauge the probability of a short- to intermediate-term reversal. It does not tell me the exact entry or exit point, but it helps me to be aware that a reversal is on the horizon.

Knowing that a short-term top/bottom is near, I am able to increase the probability of a potential trade. Conversely, knowing that a reversal is on the horizon I am able to lock in profits on a trade.

Lastly, I allow probabilities to give my strategy (credit spreads) the final edge.

And why do credit spreads give me an edge?

Let me explain it in poker terms.

Professional poker players are known to seek out “soft” or “weak” tables as a source of income. This means that the more inexperienced players there are at the table, the easier it will be for the seasoned pro to take their money.

It’s really no different in the world of options, particularly when using trading strategies with a statistical edge like credit spreads.

Finding the consistent loser or novice trader is how the poker pros generally generate the bulk of their gains. When I trade credit spreads, I take advantage of the speculation of others, typically newbies who are buying out-of-the-money calls or puts with the hope that they will eventually move into the money.

But there is, however, a skill in knowing who those amateurs are and what behaviors they exhibit to clue you in on their lack of experience.

In poker, the individual who shows too much emotion or doesn’t truly understand the game will be cleaned out in short order.

In options trading, everything is laid out in the options chain – a list of option characteristics at different strike prices. By looking at the “probability of expiring in the money” – the chance that a stock or ETF will close above (for calls) or below (for puts) the chosen strike – the options trader can make decisions based on the speculation of others. But unlike poker, the participants show their hands when trading credit spreads.

This is THE advantage credit spreads offer over any game or investment vehicle out there.

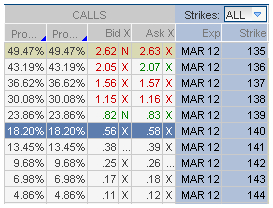

For instance, with the SPDR S&P 500 ETF (NYSEARCA:SPY) trading around $135, some traders are making wagers that SPY will move above $140 by March options expiration (March 16). The chance of the happening is 18.20%.

What about traders who think SPY will push above $142 by March options expiration? The chance of that happening is 9.68%.

With those types of odds, why wouldn’t I want to take the other side of the trade? Depending on which options I choose, my probability of success is 80%-90%.

My Step-by-Step Approach to Safely Collecting Monthly Income

During this free 58-minute video course, you’ll discover a low-risk options strategy for generating monthly income — DOUBLE what you earn now — in up, down, and even flat markets. In fact, it can hand you 5% to 15% a month — all without you having to constantly watch your brokerage account. Every level of investor will learn something from watching this insightful presentation. Don’t miss out on this income stream. Click here to watch this course now.

Facebook

Facebook

Twitter

Twitter