The market has screamed higher as of late, with the S&P 500 and Nasdaq 100 seeing gains in excess of 5.5% and 8.0%, respectively.

Do we honestly think those types of gains are sustainable without at least a short- to intermediate-term correction?

Of course not.

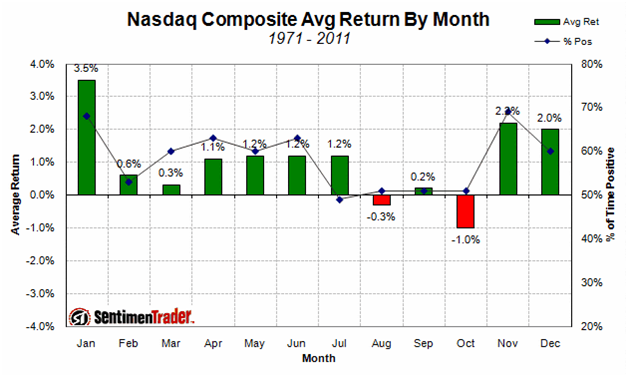

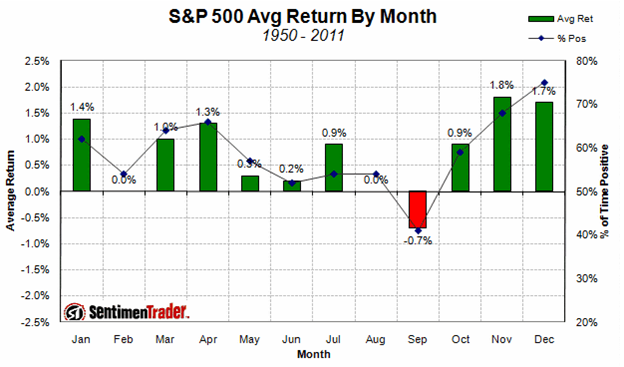

January is historically one of the strongest months of the year. Yet time and time again, investors are fooled into thinking that gains will continue throughout the year.

Some will tell you this time is different.

They’ll tell you the Fed just announced they’re holding interest rates low until late 2014.

But did they forget that the Fed announced several months ago they were holding rates low until AT LEAST mid-2013? That proclamation came near the bottom of last year’s trading range, and was followed by one of the most volatile periods in market history.

But people want to read headlines. They want the latest and greatest. Unfortunately, that type of insight is commoditized and, in my opinion, quite useless.

Here’s something I find very useful. And you won’t hear the talking heads mention it or see writers with major financial publications with no real-world financial background write about it. It’s the latest Rydex report stating that money market assets are down to $873 million because they’re moving into index funds.

Mind you they’re not moving into just any index fund. These assets are ending up in leveraged index funds. In fact, there is $275 invested in long leveraged index funds for every $100 invested in short index funds. And when I say index fund, I’m talking about those leveraged on the four major market averages – S&P 500, Nasdaq, Dow and Russell 2000.

The chart below from acclaimed sentiment analyst Jason Goepfert of Sentimentrader.com shows that each time there’s an influx of cash into leveraged funds, the market has seen an almost immediate decline.

In each of the five instances (shown by the red line above), the market has on average moved lower over the subsequent one-week (-1.1%), two-week (-1.7%), one-month (-3.5%), three-month (-5.5%) and six-month (-3.2%) time frames.

So the next time you read the bullish headline about the Fed or some hot stock or the market being due for a 20% gain over the following year, make sure there is something real behind the claim rather than someone spouting random market hogwash.

As always, if you have any questions please do not hesitate to email me at optionsadvantage@wyattresearch.com. Until next time,

Andy Crowder

Editor and Chief Options Strategist

Options Advantage and The Strike Price

Facebook

Facebook

Twitter

Twitter