Today I’m going to tell you something I probably shouldn’t.

That’s because it involves an investment strategy so easy and so simple – with incredible returns – that if you use it, you’ll never need or want to read another newsletter in your life.

The reason why most people don’t use this strategy is because it’s relatively boring. Most investors want lots of “action.”

Like casino gamblers, people want to be in and out of the game. Winning is a secondary concern to playing.

And as you’ll see, this strategy works incredibly well over the long term. We know that most people like to think they’re “long-term” investors, but we also know that the average holding period for stocks is less than 6 months.

But if you are a long term investor (or you’d like to be), here are the full details of how you can beat the market…

I call it “The Small Dogs of the Dow.”

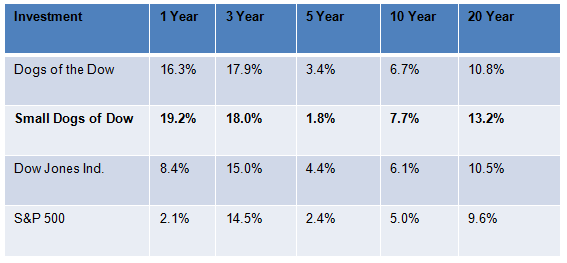

The Small Dogs of the Dow is a simple and effective strategy that has outperformed the Dow and the S&P 500 significantly over the last 20 years. Let me present this in simple terms:

“Small Dogs” of the Dow

So what is the “Small Dogs of the Dow?” And how does it work?

First, you must understand the Dogs of the Dow. These are the 10 highest yielding stocks in the Dow Jones Industrial Average. The strategy recommends buying these 10 high yield Dow stocks at the beginning of each year, and rebalancing annually. That’s just one transaction per year…

The “Small Dogs of the Dow” offers a slight twist on this winning strategy. And the results require your attention.

One of the key attractions of using the conservative strategy is that it requires very little research or time. Simply take the five lowest-priced Dogs of the Dow stocks and invest an equal sum in each stock.

Every year, the whole process starts over. Oftentimes, most of the stocks will remain on the list from one year to the next, simplifying things from a taxation perspective (no gains or losses to report) and also helping to lower commission costs.

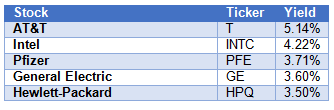

In order of current yields, the 2013 Small Dogs of the Dow are made up of the following stocks:

The Dogs have beaten the performance of the Dow 30 Industrial Average in two of the last three years. But it’s the long term record that has me convinced that this is a winning strategy.

Of particular interest to income investors is the fact that the Dogs start every year with a distinct advantage over the rest of the Industrials. This time around it’s a combined yield of nearly 4%. Compare this with a yield of 2.6% for Dow Jones Industrial Average, and the income advantage is clear.

And if you are interested in further increasing your Small Dogs of the Dow performance, please make sure to check out next week’s issue of Income & Prosperity. I will discuss how I use the Small Dogs of the Dow strategy as a foundation for doubling my dividend, thereby further increasing the performance of the market-beating strategy. Stay tuned!!!

Become a 7-Figure Investor?

It could be easier than you think. Because Ian Wyatt’s allowing a handful of readers exclusive access to the first five stocks he’s buying right now for his own account. Each one carefully selected to build the foundation for his personal 7-figure portfolio. And he’s inviting a small number of Wyatt readers to join him. Click here for complete details.

Facebook

Facebook

Twitter

Twitter