Remember all of the negative headlines a few months ago when the price of natural gas was falling like a stone?

What you probably haven’t heard lately is that natural gas prices are on the rebound in a substantial way. Since mid-April, natural gas is up nearly 50%.

Of course, after months of negative news, the market is burnt out on natural gas. Which means it’s probably worth looking into right now…

I was a little ahead of the curve.

On April 30th, I bought a stake in America’s largest pure play on natural gas: Chesapeake Energy Corporation (NYSE: CHK) in my personal brokerage account.

The company then immediately got shellacked by bad news. Not only were natural gas prices depressed, but there were some concerns about possible corporate malfeasance from the founder and then CEO of the company, Aubrey McClendon.

Of course it was bad news for the company. And the company was in dire straits in terms of profitability too.

But the important thing to remember when you’re looking for a resource asset is to find the companies that own the best of the best. And Chesapeake still owned huge stakes in natural gas assets in the best gas (and oil) producing regions of North America.

Mr. McClendon’s alleged improprieties didn’t change the reality that Chesapeake owns some of the best properties in the region.

But Chesapeake plummeted from an annual low of $18.05 (my initial buy price) down to $13.55 by the middle of May.

That’s a 25% loss I was sitting on.

Materially though, nothing had changed. Warren Buffett calls this kind of activity a “great investment opportunity” because it’s essentially a “huge but solvable problem” that momentarily drops the price of the investment.

It’s good news when an asset you want to own goes on sale – as long as the asset itself is basically unchanged.

You might note that I didn’t buy more shares of Chesapeake – but let’s look at the lesson from a larger perspective. Natural gas prices are still depressed.

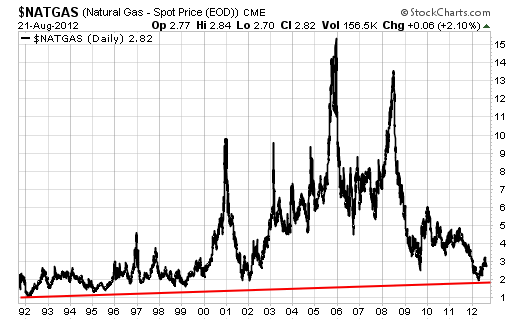

They’re barely up from their decade lows of $1.90 per thousand cubic feet (MCF):

And we know why they’re depressed: because of a glut of production and supply in the North American market.

That sounds like a huge problem that will be solved by time. The basic asset itself is the same. It’s just the price that has changed.

So while I don’t necessarily recommend picking up shares of Chesapeake right now (shares are up 45% since mid-May), the lesson is intact.

Be on the lookout for quality natural gas assets when they’re on sale. For starters, take a look at a company called Devon Energy (NYSE: DVN). They’re a domestic natural gas producer, just like Chesapeake, but they have much less debt and they haven’t had the same kind of recovery.

Look for prices below $60 a share, and if shares fall below $55 that’s a great entry point.

Facebook

Facebook

Twitter

Twitter