Small cap stocks have enjoyed tremendous strength over the past year.

Whether you own individual small cap stocks, or funds like the Russell 2000, it’s important that you understand the relative value of this asset class today. And also understand what’s contributing to small cap outperformance.

The S&P Small Cap 600 Index currently trades with a forward PE of 17.7 according to data from Yardeni research. This is the most expensive the index has been since early 2010. It’s also roughly 13% higher than the index’s average valuation over the past decade.

To be fair, rising valuations isn’t a small-cap specific phenomenon. The S&P 500 is also trading at a premium valuation – a forward PE of 14.2 – not seen since early 2010. This index is also trading more than 10% above its recent historical average.

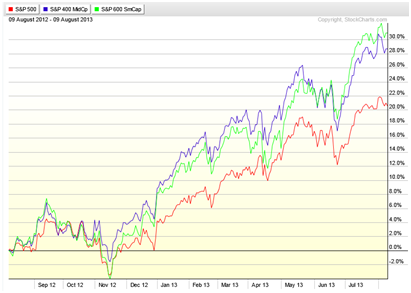

These premium valuations are the result of a stock market that has climbed steadily throughout all of 2013. The S&P 600 Small Cap Index has surged 31% over the past 12 months, surpassing handsome gains in both mid caps and large caps (see chart below).

Small Cap Stocks Lead

As a result of the recent gains and premium valuations, investors are desperately trying to figure out if it’s time to take a little money off the table. As Kenny Rogers sang in The Gambler, “You’ve got to know when to hold ‘em, and know when to fold ‘em”.

My answer is simple: continue to buy and hold top quality stocks.

One of the factors powering small-cap stocks is their higher growth potential vis-à-vis large caps. This is clearly seen in forward earnings estimates. In 2014 analysts expect small caps will grow operating earnings by 21%, whereas the consensus growth expectation for large caps is just 11.3%. More rapid growth justifies a higher valuation.

One favorable trend helping to power this growth in small companies is the U.S. economy. While we hear a lot about problems in the U.S., the country is actually doing quite well, especially compared to Europe.

Funds like as the iShares Russell 2000 ETF (NYSE:IWM) are one way to bet on U.S. growth since over 90% of holdings have a domestic focus. And I’ve been continually impressed with the consistent domestic growth opportunities pursued by many of the small caps that I cover.

I’m also encouraged by the strength in small caps despite the threat of rising interest rates. Small companies that borrow money through lines of credit, or by issuing bonds, tend to feel the pinch more than large companies do when rates go up.

But many small companies have healthy balance sheets that can stand up to moderately higher interest rates. And as I wrote last week, I believe that the Fed will only raise rates if it sees an economy that is strong enough to handle it.

Now don’t get me wrong…I’m not just another stock market cheerleader. And I’m not saying there isn’t potential for a correction in small caps. Given the overall strength in the market, the prolonged rally, and valuations nearing the high end of a “normal” range, a correction is overdue. A healthy market needs corrections and periods of consolidation.

But given what we know now, I expect that any correction will be a buying opportunity. The real pain will come if and when small caps stop performing on the metrics that matter, like revenue and earnings growth.

Right now still appears to be a good time to be invested in high growth small cap stocks. And those that trade at attractive valuations – despite previous stock market gains – will continue to offer investors the greatest upside.

I recommend you look for companies with very specific catalysts working in their favor, such as earnings and revenue growth, new product introductions, expanding market share and top-notch additions to management.

In the land of small cap stocks, companies with positive catalysts such as these continue to find growth opportunities and will continue to reward shareholders.

Facebook

Facebook

Twitter

Twitter