In an international game of 3-card Monty, it seems as though the Federal

Reserve’s Quantitative Easing (QE1/QE2) program has done little else but

to help capitalize insolvent European banks.

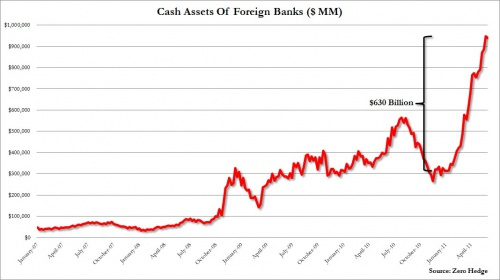

Take a look at the chart below, which shows the “coincidental” infusion

of nearly $700 billion into the balance sheets of Foreign banks at the

same time that the Federal Reserve pumped the same amount of money into

the markets via QE2.

It’s not clear exactly how the funds ended up on the balance sheets of the

European banks, but what is clear is that American banks experienced no

such balance sheet boost over the same period. Why is the Fed now

backstopping European banks? Well it’s pretty clear that Europe’s sovereign

debt issues are somewhat more advanced that America’s, so maybe Bernanke is

trying to quarantine those issues to the other side of the Atlantic.

In any event, the effect is clear, regardless of how it’s achieved.

And the lesson to be learned is now an old one: you can’t trust the Fed

or the banks.

If you’re interested in investing in a bank that has nothing to do with

the Fed, Wall Street or the typical too-big-to-fail “bankster”

institutions, check out the full write up on a Manhattan bank that didn’t

take a dime in bailouts. And it’s currently paying an 8.2% dividend to

shareholders.

Facebook

Facebook

Twitter

Twitter