Wynn Resorts (NYSE: WYNN) has surged during the past eight months, although its luck may be running out.

ChartWatch has been bullish on casino operators for some time. In fact, ChartWatch explained why Las Vegas Sands (NYSE: LVS) traders were going to hit the jackpot last August. The shares were below $36 at the time, and our research showed that the stock should ascend to $50, which it did within several months.

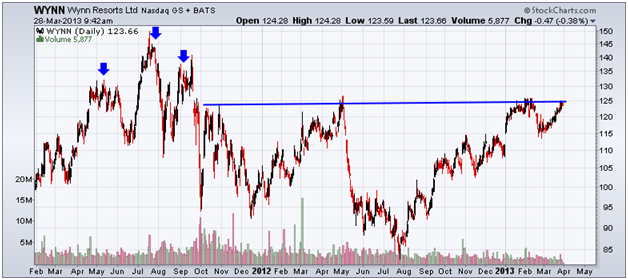

Though casino businesses should do well in the future, stock prices – WYNN in particular – may encounter some near-term selling. The two-year chart reveals several strong resistance zones at $125 and above.

With the shares near $125, I’d expect WYNN to slow down as they meet $125 lateral resistance (blue line).The shares have climbed 50% from an August low, and investors may feel extra pressure to cash in. It’s also concerning that WYNN topped in February, as opposed to most other stocks, which currently trade at new rally highs. That said, a decline that takes the stock below $100 appears unlikely because this is such a strong company, and buyers did an amazing job building up support areas during this rally.

This chart shows the price of WYNN shares along with an important resistance region to monitor.

And in the event that WYNN powers above $125, buyers will face strong sellers at three other resistance areas (blue arrows). The most difficult should be the $130 zone because it’s the area where sellers were the fiercest in 2011. However, $135 and $145 will be levels of selling pressure, too.

It may be time to capture your gains in WYNN since it’s enjoyed such a strong rise since August and faces several layers of selling pressure. However, I’d keep the stock on your radar as it pulls back.

WYNN yields 3.3% and has an 18 forward P/E ratio. Were the shares to decline by 15%, the yield would increase to 3.8% and the forward P/E would fall to around 15. WYNN would be an excellent value for investors at a slightly lower price.

Equities mentioned in this article: WYNN, LVS

Positions held in companies mentioned above:

Facebook

Facebook

Twitter

Twitter