Honda Motors (NYSE: HMC) stock is geared up and prepared to power to $40 a share.

The shares of this global auto manufacturer struggled to move higher over the past two years. Though global economic worries are partially to blame, the biggest challenge Honda faced was a strong yen.

Honda is a major automobile provider in Japan, but it also exports its machines around the world. As the yen increased by 60% over the past five years, Honda’s products became less competitive. This lack of competition resulted in sluggish sales and no stock price appreciation.

Now that the global economy is on the mend and the yen has stopped appreciating, HMC shares should pick up steam.

Considering Honda is a world leader in the automotive market, the shares are cheap. Analysts predict HMC will earn $3.81 per share this year, equating to a P/E of 8.5. Three months ago, the P/E was 13.

Not only is the stock cheap, HMC comes with a 2.2% cash dividend.

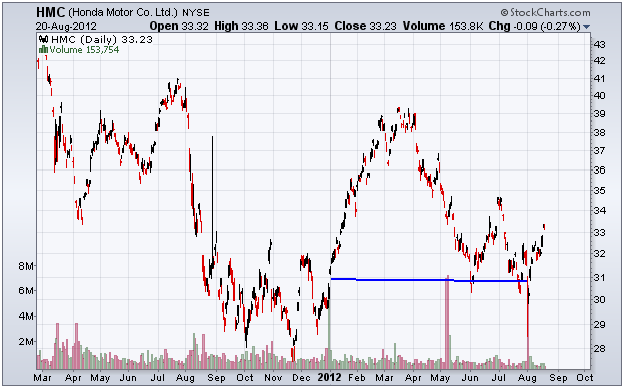

The time to buy Honda Motors may be now. The shares bounced off a strong support level (blue line). This line should protect the shares from a decline and provide momentum for HMC to retest $40.

HMC is likely a $48 stock based on valuation. However, it could take a few years for the market to realize this value. Over the next several months, I would be looking for something near $40.

Of course, if for some reason $31 breaks — then sell everything.

Facebook

Facebook

Twitter

Twitter