Here at Wyatt Research we editors and researchers do not march in lockstep – espousing the same “company views.”

And sometimes, I find myself so deeply in disagreement with my colleagues that I have to say something.

Recently, my colleague Jason Cimpl authored two pieces basically saying that inflation won’t be serious and that there’s no sense in worrying about hyperinflation in particular.

He lays out lots of data, charts and well-reasoned thoughts on the topic. And while his proof is convincing and his research undisputed, I believe we will eventually find them to be wrong.

I believe we are likely to see high inflation and perhaps even hyperinflation of the U.S. dollar at some point in the not-so-distant future.

Where won’t we see inflation? Well, we won’t see any proof of serious inflation from the Consumer Price Index, a piece of data compiled by the Bureau of Labor and Statistics.

We already intuitively and actively know that CPI is useless or mum on the topic of healthcare, tuition, energy, food, real estate and the price of many vital raw goods – which are all outside the purview of the CPI.

If you consume any of those goods or services, you already know that prices have absolutely soared – perhaps not yet to hyperinflationary standards, but they’ve soared nonetheless.

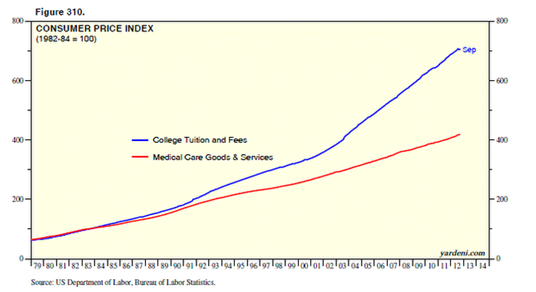

For two small examples, take a look at the chart below showing inflation in the price of healthcare and tuition:

It’s frustrating to see some items skyrocket in price, and then hear from the CPI numbers that we’re chugging along at super-low inflation rates.

So at the very least, I argue that we could be in the midst of significant inflation – much more significant than what our government tells us.

I don’t believe these numbers, and as well researched as they may be, I find them to be ultimately uninformative when we’re talking about hyperinflation – which in my view is a serious concern.

A hyperinflationary event does not require massive money printing. Think about what hyperinflation means. The standard definition is 50% inflation on a monthly basis.

That means that a currency loses 50% or more of its value over the course of a month.

Since everyone freely admits that the dollar is just a piece of paper – and that its intrinsic (real) value is essentially zero – we don’t need much of a catalyst for the dollar to revert to its true value.

It could be as something as simple (and inevitable) as the dollar losing its world currency status. We’re currently seeing the rise of the Chinese economy and the yuan with it. When the dollar loses its reserve currency status, the great bulk of those dollars held overseas will come home in a hurry – for the simple reason that they won’t carry much weight anywhere else.

Or maybe there’s a war that destroys our financial system.

Or maybe we see modest inflation – and people fly to other assets or currencies out of fear.

My point is, a hyperinflationary event is not itself something that you can divine from numbers, charts and statistics – because it’s something outside of statistics and numbers.

Such a crisis has more to do with human psychology than it does with finance or math. It’s not a rational market decision for a great bulk of people who up and desert the currency system that they’ve known and loved since birth.

And when hyperinflation visits, it happens quickly.

Jason does recommend buying gold – and I agree with that point. If you don’t own portable assets of high value when hyperinflation comes, you will not be well prepared.

Facebook

Facebook

Twitter

Twitter