Something amazing happens when a company grows its dividend payout by 10% a year.

First off, we get 10% more in dividend payments each year – that’s obvious. And secondly, we can reasonably expect that over the long term, the stock price will go up by about 10% per year too.

This means that the current yield stays the same, since the stock price moves higher with the dividend.

But earlier this month, we had to sell McCormick & Co. (NYSE: MKC) in our High Yield Wealth portfolio because it grew at a faster pace than the dividend.

McCormick sells a variety of spices and condiments – some of which are likely in your spice rack, if not in the food you buy from the supermarket. Like many of the best dividend stocks, this company is pretty straightforward and relatively boring.

I first recommended this dividend stock back in June 2011, when shares traded at $48 – selling for just 19X earnings.

At the time, McCormick paid a quarterly dividend of $0.28. And the yield was 2.3%.

What happened with McCormick was that the dividend went up by 20% in two years, but the stock price went up by 40%.

McCormick isn’t trading at 19x EPS anymore. It’s trading at 24x EPS. And at that valuation, the stock is richly priced relative to the company’s growth rate, the market in general, and its historical valuation.

While McCormick will likely continue to grow its dividend for years to come, the share price today is too rich. Today, the downside of seeing our capital gains erode outweighs the upside of further dividend growth.

So it’s best to lock in our profits at a rich valuation, and find a new dividend grower that is reasonably priced.

Even good companies, and good dividend payers, can be over valued. When they are considerably overvalued, it’s time to sell. I would love to buy McCormick at 19x EPS again. And when the stock trades there, pays a 3% yield, and is growing the dividend at 10% per year, we’ll buy it again.

The story of McCormick highlights the reason why every income investor must focus on dividend growth. Good things happen when you buy a dividend grower – and sometimes the market gives you a chance to book a substantial gain.

Since my recommendation, shares are up 42%. Adding in the dividends collected, the total gain on this dividend grower was an impressive 48%.

McCormick is in a selective group of companies that have outperformed over the long-term. These companies are known as dividend growers. They raise their dividend payments year after year, rewarding their shareholders with an ever-growing portion of the profits.

The evidence for investing in dividend growers is considerable. Over the past 30 years, S&P 500 stocks that grew their dividends easily beat the performance of every other class of stocks. The companies that are committed to increasing their dividends did better than high yield stocks, better than dividend payers in general, and better than non-dividend payers.

30 Years of Outperformance

| Dividend Growers | 9.5% |

| Dividend Payers | 7.2% |

| No Dividends | 1.6% |

The long-term evidence is considerable. But now may be the best time to invest in dividend growers.

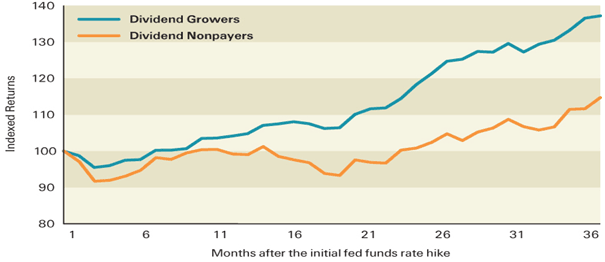

That’s because renowned research firm Ned Davis found that dividend growers significantly outperform when interest rates are rising.

In a three-year period after an interest rate hike by Fed, dividend growers gain nearly 40%. Meanwhile, dividend payers as a whole gained roughly 15%.

Dividend Growers Are Best Performers

With stocks up so much in the last year, finding value is a top concern of mine. And now isn’t a great time to own richly priced stocks like McCormick.

Instead, it’s time to find reasonably priced stocks that have a track record of sharing the profits with investors, and a history of increasing the size of those payments year after year. High yields alone aren’t enough to grow your wealth for the long-term.

I want to hear about your favorite dividend growers. Drop me an email at editor@incomeandprosperity.com, and I’ll evaluate some of your ideas in an upcoming issue of Income & Prosperity.

Facebook

Facebook

Twitter

Twitter