Another day, and still no agreement on a 2011 budget in Congress. Surprisingly though, the stock market is not really being affected by the impasse. Sure, the major indices are down slightly again today, but I think we can all imagine that it could be much worse.

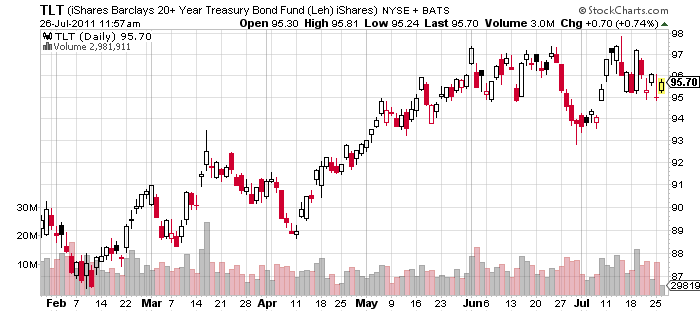

Treasury bond prices have been choppy, with big $3 price swings on the chart of the iShares Barclays 20+ Year Treasury Bond ETF (TLT) in July. But overall, bonds are holding up well, and this tells us clearly that no one expects the U.S. government to default on its bond payments.

So you know, TLT is always a good ETF to track because it gives us an neat easy picture for how much investors bought.

———-

Gold prices have been strong, and some would probably say this is a reaction to the default potential, but again, bonds are telling the real story. Default is a highly unlikely event.

Gold prices may well be the red herring in the debt debate. I won’t be surprised to see gold sell-off some when the debt debate is resolved.

———-

I would also suggest that the market’s non-reaction to the budget impasse is an indication that current valuations are attractive. If investors were truly worried about stock prices, the default fear would be a perfect catalyst for a move lower. But it’s just not happening.

I expect there is some upside for stocks once this debt situation gets resolved.

Of course, we won’t see any significant spending cuts. And we also won’t see any tax increases. It’s a pretty lame response, and it’s also expected.

———-

Consumer confidence rose for July. That’s surprising, given the political uncertainty surrounding the debt deal. But again it underscores the belief that default will not happen.

———-

Opinion polls show that dissatisfaction with both the Obama administration and Congress is on the rise.

———-

Hedge fund pioneer George Soros is standing down. It’s being reported today that Soros is returning outside money, and will focus on running his family’s money. That’s around $24 billion, if you’re counting at home.

The man’s 80 years old, so I’m not surprised he’s going into semi-retirement. I will miss his quotes and insights about the global economy and investing.

Facebook

Facebook

Twitter

Twitter