I don’t own any physical platinum bullion.

But if you’ve been following along for the past year or so, you might remember that I do like to trade platinum.

Before I go any further, I’d like to quickly point out my terminology: I trade and sell platinum. I don’t invest in it. I don’t keep it, hold it or put it in a vault. I don’t plan on using my platinum holdings as part of the same long-term wealth protection strategy that I employ with gold and silver.

None of the rules that apply to buying and holding real hold-in-your-hand bullion apply when you’re trading platinum – or any other asset for that matter.

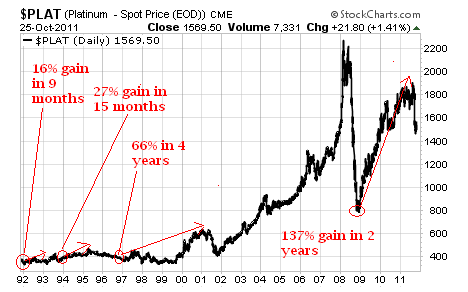

I trade and sell platinum under a very specific set of circumstances that tends to result in 10-150% gains in 1-24 months.

The premise of the trade is simple: platinum is rarer than gold, has plenty of industrial/jewelry/electronic uses – and sometimes, for a variety of reasons, sells for LESS than gold does.

During these rare occasions, it’s been a relatively profitable venture, as you can see in the chart below:

How do I trade platinum? Simple: I just wait until platinum sells for less than gold (according to NYMEX or any global commodity market) and then I buy shares of the ETFS Physical Platinum Shares Fund (NYSE: PPLT).

Right now, I’m sitting on about 10% gains after buying this ETF back in November of 2011.

And while platinum has skyrocketed since mid-August (rising 20% since then) it’s STILL less expensive than gold.

Therefore, it’s also STILL a trade you might consider making.

As soon as it’s more expensive than gold, you sell your shares in PPLT.

I’ll be keeping tabs on this trade – and I’ll let you know what I’m up to.

Facebook

Facebook

Twitter

Twitter