Master Limited Partnerships – or MLPs – can appear be attractive…

With 8%, 9%, even 10% yields at times.

Enticing, but I’ll look the other way.

Why?

At times these yields can be a mirage at times: Now you see them, now you don’t.

What’s more, the paperwork can be at royal pain at tax time.

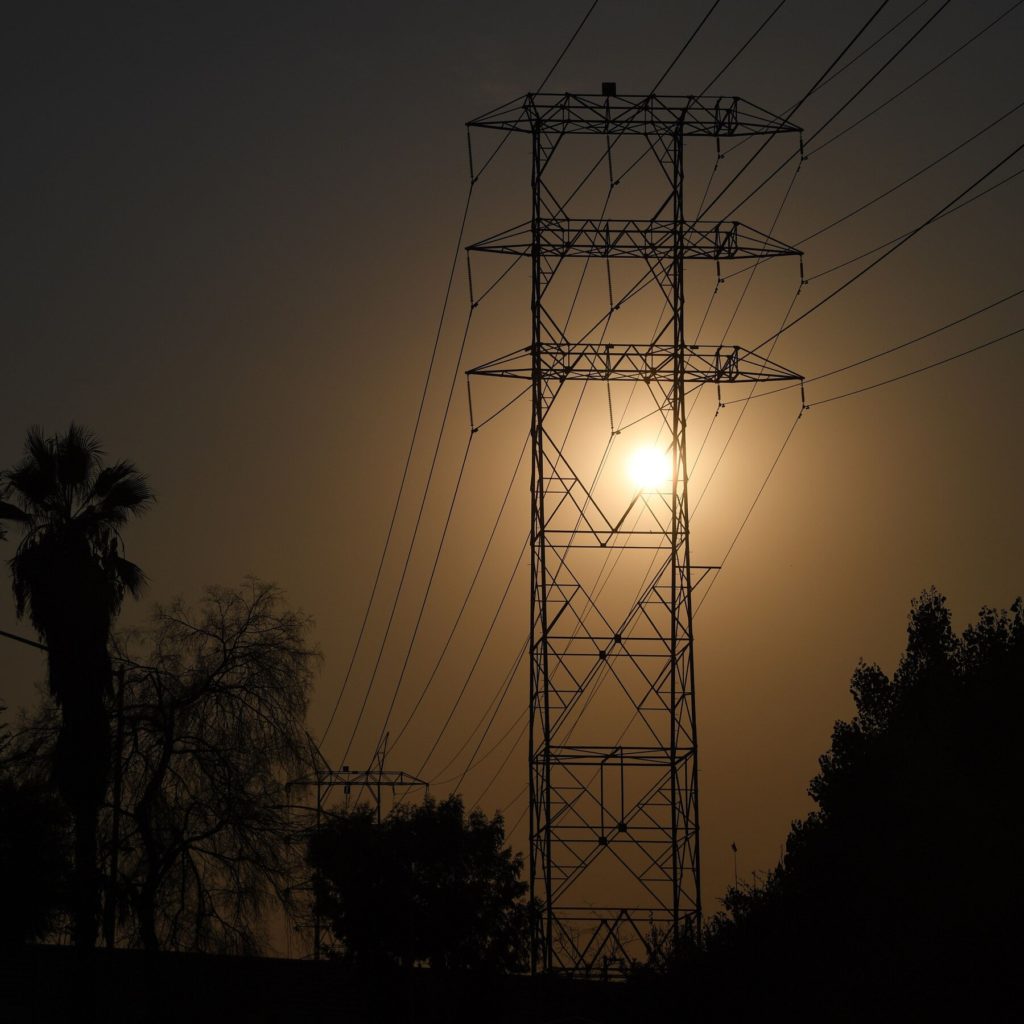

Most of the energy MLPs center on oil and natural gas pipelines and storage (a lesser number center on exploration).

Because MLPs are pass-through entities and pay no federal income tax, they pay high-yield distributions – 4x the S&P 500 Index and 2x to 3x most other energy investments.

For instance, Energy Transfer LP (NYSE: ET), a large natural-gas pipeline and storage MLP, pays a distribution that yields 9.8%.

Exxon Mobil (NYSE: XOM), a large integrated energy company, pays a dividend that yields 3.5%.

Energy Transfer wins on absolute income and yield. But not on consistency, as the chart reveals.

Exxon Mobil’s dividend, on the other hand, is a model of consistency. That is, consistent dividend growth.

All energy companies will see their value wax and wane with the underlying commodity price.

MLPs are more sensitive to commodity prices because they add little value to the commodity:

Get it out of the ground, move it, and store it. That’s the extent of the value-added.

That said, the distribution yields are enticing when energy prices are rising. Energy Transfer has doubled its quarterly distribution over the past 18 months.

You pay for consistency with a lower yield in Exxon Mobil Stock. You are compensated for accepting higher volatility with Energy Transfer’s yield.

I have owned Energy Transfer. I own Exxon Mobil. I’m not impugning the one nor endorsing the other. They are both fine enterprises for what they do.

The unstable distribution is one reason I don’t own MLPs. Tax compliance is another.

MLPs issue form K-1 at tax time. They can be problematic. Many numbers must be slotted into many places on the tax return: percentage interest in the overall partnership, capital account balances, and other partnership concepts are often unclear. The paperwork can confuse professional tax preparers.

Worse yet, and I speak from experience, the K-1 often arrives late – after April 15, which induces another round of headaches with the amended tax return that needs filing.

So, MLPs are off the table, at least in their pure incarnation.

Owning an MLP within an exchange-traded fund (ETF) is a worthwhile alternative at times

You get the high-yield of an MLP sans the K-1. (ETFs issue form 1099-DIV). You also get the added benefit of diversification.

The Alerian MLP ETF (NYSE: ET) is the most popular of the MLP/ETF bunch. It owns 20 large oil and natural gas pipeline and storage MLPs (including Energy Transfer).

Alerian’s dividend yields 8.3%.

I again speak from experience. I have owned the Alerian MLP ETF. Tax preparation, I won’t say enjoyable, was less of a hassle. The dividend yield wasn’t too bad either.

Facebook

Facebook

Twitter

Twitter