Monday is going to be an important day here at Wyatt Investment Research. And not just because there will be a flood of renewed interest in the stock market after a long holiday weekend.

On Monday Ian Wyatt will be releasing the name of his next buy recommendation for his $100K Portfolio advisory service. This is Ian’s real money portfolio where he invests right alongside subscribers, putting his money where his mouth is. Ian recommends investments with the conviction of his own finances – something you rarely see in the financial world.

This recommendation could be Ian’s most talked about recommendation of the year…because he is stepping back into a market that most investors have left for dead.

Regular Daily Profit readers know that we produce a lot of research and commentary on gold and gold stocks. So you already know that these assets have been absolutely butchered in recent months, destroying the portfolios of even the most well seasoned gold investors.

You also know that we’ve urged caution in the gold market…asking you to be patient and wait for the rampant selling to ease.

Nobody wants to buy gold assets right now. But recently Ian has found a “gold” company that he believes could be his best idea of the year. This upside potential comes from an investing strategy that’s extremely difficult to stick to; buy when there is blood in the streets.

Right now the streets are flooded after gold has fallen from $1,800 an ounce in October of 2012 to just $1,200 today. That 33% plunge has been difficult to stomach.

Many mining companies are on the verge of going out of business right now. They just don’t have the capital to keep their mines on line. And many gold stocks have fallen so far that issuing more shares at these prices (to raise capital) is akin to giving away the company. In other words, the drop in gold’s price has created a huge black hole in the mining industry’s finances.

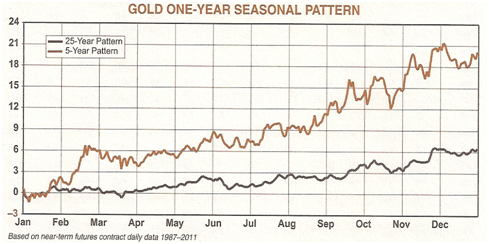

But there is some good news. Starting as early as Monday, gold enters a seasonally strong period that lasts through July and extends deeper toward the end of the year. Jeffrey Hirsch from the Stock Trader’s Almanac says the drivers of this price strength are increasing demand out of India, where jewelers stock up ahead of the wedding season, and a (historical) return of investment demand as many traders return from vacation.

The following chart, courtesy of the Commodity Trader’s Almanac, shows exactly what I mean. Notice how both the 5-year and 25-year price patterns show gold’s weakness in June bottoming in July, and then strengthening throughout the rest of the year. If this pattern plays out again in 2013, the upside in the precious metal could be substantial.

But the “gold” stock Ian will be recommending to $100K Portfolio subscribers on Monday isn’t a straight play on rebounding gold prices…even though a stronger gold price will certainly help this investment.

Rather, Ian has uncovered what he calls the “British Columbia Gold Bank,” a conservative gold investment that doesn’t incur all the direct mining-related costs of pure gold miners. This unique corporate structure insulates the company from the same cost inflation that has hurt miners, while providing more leverage to the price of gold than straight gold ETFs.

As I mentioned earlier, Ian will be buying this stock in his own real-money portfolio. But first, he’s giving his subscribers a chance to buy in. I can’t get into any more details today, but I can say that the drop in gold’s price has created a rare and profitable opportunity for $100K Portfolio this unique investment.

Ian will publish his complete report in Monday’s issue of the $100K Portfolio. You can learn how to take advantage of this opportunity right here.

Good Investing,

Tyler Laundon, MBA

Facebook

Facebook

Twitter

Twitter