Does the U.S. debt ceiling debate have you pulling out your hair yet? Maybe it's time to focus your investment attention toward warmer climates, at least for the winter.

Latin America includes several of the world's most consistently growing economies. Vast reserves of natural resources – from copper and gold to timber – are a major contributor to that growth. And with lower net debt levels than here in the U.S., several Latin America countries have been attracting more and more foreign investment.

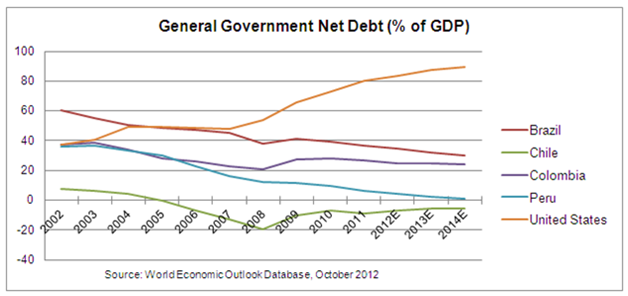

We're all pretty tired of hearing about rising debt levels in the U.S., especially as the reality sets in that with no game plan to cut the nation's debt load we'll just pass this on to our children. The following chart shows some astounding trends in my opinion. Since 2002, net debt in the U.S. has more than doubled.

By comparison, net debt levels in the four South American countries of Brazil, Chile, Colombia and Peru are all lower since 2002. Aside from Chile, which is actually running a surplus, each of the remaining countries is trending toward lower net debt levels, and all are well below 40%.

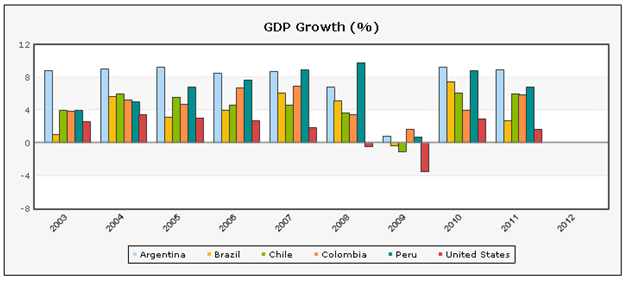

As we know all too well here in the U.S., it's hard to get out of debt without growth. That's not a problem down south.

All of these economies (I added Argentina to this list) have been growing faster than the U.S. economy for a long time, with Argentina, Colombia and Peru even growing through the years of the global financial crisis.

Source: World Bank

Source: World Bank

That GDP growth is helping to raise the standard of living for many of these countries' citizens. Growth in per capita income helps to grow domestic consumption and therefore helps resource-rich countries move to a healthier mix of foreign and domestic-powered consumption.

And natural-resource wealth Latin America has, in spades. Chile produces around a third of the world's copper. It's the biggest producer in the world. Peru is number two. You have likely purchased Chilean wine and salmon at your local liquor and grocery stores. And beyond being the driest place on earth, the Atacama Desert in Chile hosts massive and valuable reserves of iodine, nitrates, lithium, potassium and copper.

Access to Latin American markets is becoming easier for retail investors as well. There are now more than two dozen ETFs with targeted Latin American exposure. An increasing number of South American companies are finding that listings in the U.S. significantly boost awareness of their growth stories. Some beneficiaries of resource-powered growth, such as banks, have U.S. listings that allow exposure to specific countries.

The best example is probably Madrid, Spain-based Banco Santander (NYSE:SAN), which has country-specific equities for Chile branches – Banco Santander Chile (NYSE: BSAC) – and Brazil branches – Banco Santander-Brazil (NYSE:BSBR).

It's not as though there are no risks investing in South American economies. Obviously there are. And I wouldn't suggest that historical trends in GDP growth and net debt levels will continue forever. They won't.

But these countries are worth a solid look, especially in today's market. Compared to plowing more money into a U.S. index like the S&P 500, country-specific ETFs in South America might offer a much higher return.

Unfortunately I won't make the trip to Latin America this winter. But that won't stop me from planning a future trip. Until then, I'll be rounding out my investment portfolio with the best stocks and ETFs South America has to offer, and you should too.

Additional Reading: I recently completed an in-depth report on Latin America and five easy-to-access investments for subscribers to Pay Dirt. You can get the full report with a trial subscription to Pay Dirt by clicking here.

Good Investing,

Tyler Laundon, MBA

Facebook

Facebook

Twitter

Twitter