Editor’s Note: I’m pleased to introduce you to Brit Ryle. Brit’s our newest contributor to the Daily Profit. Brit is a talented trader who has uncovered huge gains including 345% on Chewy, 473% on Palo Alto, and 1,170% on Twilio. Brit was actually the founding editor of Daily Profit back in 2008. And I’m thrilled to have him back on the team! – Ian Wyatt

It is one of those old standards that gets taken as gospel – when the Fed starts hiking interest rates, unemployment will spike and the U.S. economy will fall into recession.

Economists and strategists alike have been saying a recession is right around the corner for nearly a year now…

The recession chorus was deafening when Silicon Valley and First Republic Banks went belly up in March. Recession is here! It’s 2008-9 all over again!

But here we are.

First quarter GDP was just revised higher – from 1.2% to 2%. And that level of growth was achieved during the same 3-month period that saw those bank failures.

Now look inflation has been trending lower for 10 months – almost as long as the fearmongers have been predicting a recession. Wage inflation has also been weakening, even though the labor market has been rocksteady…

Supply chains are mostly back to normal and transportation costs have fallen dramatically.

And just in the last few days, we got very strong growth for Durable Goods Orders, New Home Sales absolutely crushed, coming in with 12% growth when the economists were expecting a decline of -1.2%. And Consumer Sentiment hit an 18-month high.

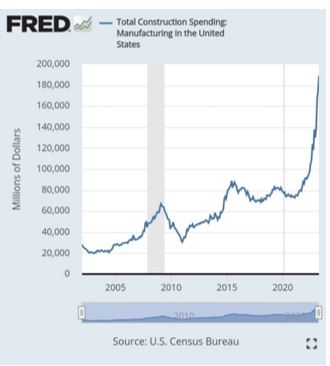

But maybe the most compelling is the absolute boom we are seeing in the U.S. manufacturing sector. Check out this chart from the Fed:

We haven’t seen this level of Investment in American manufacturing in, well, ever. It’s almost literally off the charts…

Does all this look like an economy that’s falling into recession to you?

Not only is America likely to avoid the recession that everyone’s been predicting — all signs point to a boom time of growth on the horizon…

More and better jobs, a renewed middle class, and of course, a new bull market that will raise household wealth across the board.

I know — the financial media is obsessed with what they see as a market driven by just a handful of Big Tech stocks. But that’s just not the case. 10% of the S&P 500 is making new 52-week highs right now.

Artificial Intelligence (AI) stocks are obviously booming. The electric vehicle (EV) market is at a tipping point as companies rally around Tesla’s supercharging standard. Renewable energy projects are cropping up everywhere, and of course, infrastructure investment is transforming the industrial sector.

You can wait for the stock market to hit new highs if you want. Or you can take action now and start profiting ahead of the crowd…

Big tech stocks are soaring – all thank to AI.

MSFT is +43%. META is +132%. And NVDA is +195%.

The monster tech stocks have been getting all the investor attention – with Jim Cramer calling them the Magnificent Seven.

Yours in Wealth,

Brit Ryle

Facebook

Facebook

Twitter

Twitter