With shares trading above $141…

Nvidia (NASDAQ: NVDA) recently hit another record high.

And the company’s market value has now topped $3.5 trillion!

There are two big reasons Nvidia shares could continue roaring higher…

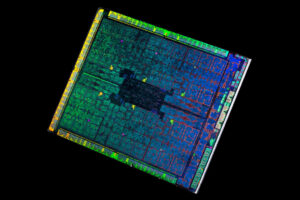

First, Nvidia’s next generation Blackwell AI chips are fixed.

There had been a flaw with Blackwell that delayed production.

CEO Jensen Huang says the design flaw has been corrected. And Nvidia will be shipping Blackwell chips to customers before the end of this year.

There remains huge demand for this breakthrough AI chip that’s far more powerful and energy efficient.

Blackwell will fuel continued growth for Nvidia in 2025.

Second, earnings season news could boost Nvidia shares.

Big tech stocks are reporting earnings next week.

This includes quarterly financial reports from Google, Microsoft, Meta, Apple and Amazon.

It’s important to see what these companies say regarding AI. And most importantly – regarding their capital spending on AI infrastructure.

Bullish comments and big spending on AI will be good news for Nvidia stock.

In late August NVDA shares fell after its earnings report.

That’s when I wrote…

“Nvidia put up another very, very solid quarter. The company beat expectations and raised guidance. Plus, we now know that delay issues with Blackwell are in the rear-view mirror.

I’m expecting that the NVDA will trade at $150 per share within the next 12-months.”

I personally bought more NVDA shares in early September. And the stock has gone from $102 in early September to $140 today.

Hopefully you joined me and “doubled down” when NVDA shares dipped last month.

A new AI trading bot can alert you to winning trades in ANY type of market.

This is only possible thanks to a breakthrough known as “predictive AI.”

This AI Trading Bot has recently delivered profits of…

- 36% in Micron in 3 days

- 46% in Rivian in 13 days

- 72% in Amazon in 15 days

- 98% in Apple in 6 days

- 144% in Tesla in 24-hours

- 359% in AMD in 7 days

Want to get the NAMES and TICKERS for the next 3 trades?

Go here for urgent details and the next trades.

Ian

Facebook

Facebook

Twitter

Twitter