Nvidia’s $3 trillion market cap…

Briefly overtook Apple as the 2nd most valuable company.

Many investors are shocked that Nvidia could be worth as much as Apple.

Apple is a much larger company than Nvidia. It has 3x more revenues and 5x more employees.

Nvidia’s big advantage is that it’s growing at a breakneck speed. Frankly, I’ve never seen a couple of this size growing by triple digits.

This morning I’ll do a deep dive into the size and valuation of these two tech giants.

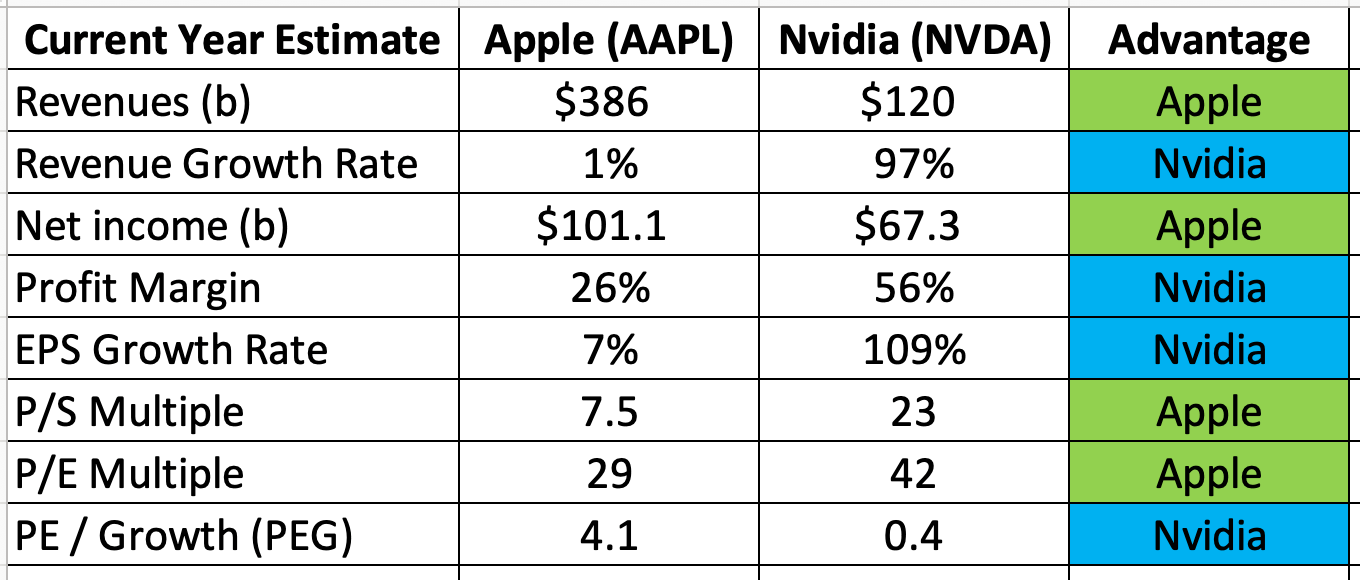

I created this table with 8 key metrics for Apple and Nvidia. Hopefully this helps highlight the differences.

Revenues

Apple is expected to have $386 billion in revenues in the current year (ending Sept. 30). That’s less than a 1% increase from last year.

Nvidia revenues are expected to approach $120 billion in the current year (ending Jan. 31). That’s a 97% increase from the previous fiscal year.

Earnings Per Share (EPS)

Apple non-GAAP EPS are expected to increase 7.3%. Significant stock buybacks contributing positively to Apple’s outsized earnings growth.

Nvidia non-GAAP EPS are projected to jump 109%. That’s lower than 288% growth last year. However, it’s still 15x faster growth than Apple.

Valuation

You can also see big differences between these two companies with the valuation.

- Apple: 7.5x sales and 29x EPS for the next 12-months.

- Nvidia: 23x sales and 42x EPS for the next 12-months.

Apple is a mature company. It has with huge established streams of revenue and very healthy profit margins. The stock trades at a premium to the average stock in the S&P 500.

Nvidia is experiencing a period of rapid growth that began in 2023. The stock trades at a large premium to Apple and the S&P 500. However, the valuation appears reasonable if the company can sustain +20% growth in the coming years.

I’m “long” both Apple with 1,288% gains and Nvidia with +135% gains. And I continue to see upside to both stocks.

Ian

Facebook

Facebook

Twitter

Twitter