- My two favorite ways to buy silver

- One good reason to buy silver now

- Why the price of gold won’t matter

- An insurance policy you can sell if you don’t use it

It’s full disclosure time! As

you might have realized, I’m long term bullish on gold and silver as well as

most other commodities. But over the past 6 months I’ve mostly been loading up

on silver.

As I’ve

said many times in past issues of the Resource Prospector I buy my gold

and silver from one of two online dealers: kitco.com

and Blanchard online. I have no

professional relationship and I don’t get any kickbacks from either of these

two companies – I’m paying full-board just like any other regular investor. I

can recommend them because I’ve had good, responsive and professional

experiences with both – AND they both have buy-back guarantees.

The only reason I’ll buy

from one dealer over another is when they’re running special deals or they have

a specific denomination of bullion that I’ve been looking for.

For instance, there’s a coin

that Blanchard currently sells that was minted by the Swiss government between 1897

and 1949 called the Switzerland Helvetia 20 Franc coin. For many years this

coin was traditionally gifted to newly married couples. At about 0.19 ounces (or just under 1/5 of an

ounce) it’s an affordable, yet generous denomination of coin. It just so

happens that my friend and co-worker Steve just got married to his long-time

girlfriend and high school sweetheart Mallory. I’ve been looking for one of these coins (pictured below) to give as a

wedding present.

But – I’m hesitant to buy

anymore gold, even as a gift, while it’s selling near all-time highs.

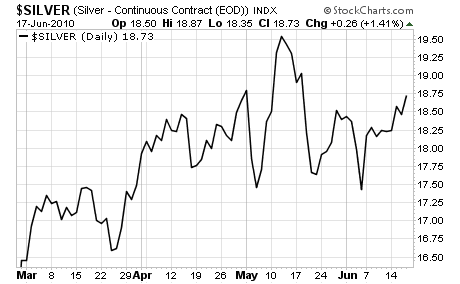

That’s one

reason I’m buying silver: it’s still cheap. Today, silver sells for under $19

an ounce.

In 1981, silver briefly sold

for over $50 an ounce. So if silver catches up to its historic, inflation

adjusted highs, it would sell for over $300 an ounce.

If you look at the modern

gold-silver ratio of 55:1 you can see that silver is currently about 20% too

cheap in comparison to gold:

Gold is much closer to its

inflation adjusted highs of about $2,300 an ounce. I don’t think gold will stop

at $2,300 – and I believe that its long term dollar valuation is somewhat

irrelevant. The long term trend is for gold to be worth near-infinite amounts

of paper dollars.

If

hyper-inflation is in the cards, the question of how many dollars can I get for

an ounce of gold just won’t matter. The better question will be: how many

gallons of gasoline can I get, or how many pounds of rice, or how many

cartridges of .357 ammunition? I mean, did anyone in Weimar Germany

really care about how many Deutsche Marks they could get for an ounce of

gold? No.

That’s somewhat off topic.

Right now, I’m buying silver

because it’s undervalued relative to gold, and it’s nowhere near its nominal

highs, let alone inflation adjusted highs.

One of the primary reasons I

own silver has almost nothing to do with its current valuation.

Silver has some more tangible

benefits in the event of a total currency meltdown. That’s because it has a

much lower value-per-unit than gold.

I’ll tell you now what I’ve

told my immediate family members. Tally up your living expenses (food, water,

gasoline, etc.) for three months, and buy the commensurate amount of gold and

silver.

I consider

physical gold and silver to be an insurance policy that you can cash in if and

when the dollar implodes. In that event, your daily expenses will likely be

more easily met by silver bullion than gold. A one ounce gold coin is a large

amount of money, so unless you’re buying food for a dozen people, it would be

tough to find daily living expenses that would require gold bullion.

Silver coins are much better

suited to daily expenses like food and gasoline.

I realize that this type of

discussion borders on the insane – but don’t think of it that way. Think of

your physical gold and silver as an insurance policy. You probably already have

fire insurance – though you don’t believe your house will burn down. If you’re

like most people, you have a life insurance policy that you’ve paid into

forever – though you’re hopefully not planning on dying in the near future.

So, I’m buying silver for

the same reason. In the event that the dollars in my bank account become

worthless, or near-worthless, I want to have something that I can fall back on

– as an insurance policy. Even if I’m wrong, and the dollar isn’t due for Zimbabwe or Weimar style inflation, I can always sell

back my silver and gold and recoup some of that insurance premium.

Try doing that with your

life insurance.

Have a good weekend,

Kevin McElroy

Editor

Resource Prospector

p.s. I’d be remiss if I

didn’t mention a low-cost American silver producer that my boss Ian Wyatt

recently added to the Small Cap Investor

Pro portfolio. This company JUST turned profitable at $16.75 silver, and

prices have been steadily rising since it last reported – so any further upside

in silver’s price will be a boon for shareholders. I’ll be discussing exactly

how you can buy this company early next week, so look for my update in your

inbox. You can take a test drive of Ian’s portfolio by clicking here.

Facebook

Facebook

Twitter

Twitter