Something strange is happening with major gold

stocks.

I’m talking about the 16 largest publicly traded gold companies that

comprise the AMEX gold bugs index.

And no, you can’t buy this index – it’s not an ETF.

But it’s a good measuring stick to see how gold majors perform.

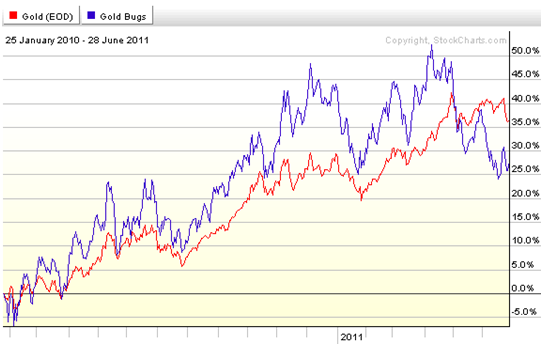

And right now, they’re not doing so well. The chart below plots the price

performance of gold vs. the price performance of the gold bugs index since

the beginning of 2010.

You can see how during this latest leg of the bull run in gold, that the

gold bugs have tended to outperform gains in the underlying metal.

And that makes sense. These companies have fixed costs, and when the price

of gold rises, their profits and margins rise as well. So if they make $1

per share when gold is $100, you’d expect that they would be able to make

$2 if gold hits $101. Every increase in gold’s price over that $100 lets

them multiply their profits.

Obviously, it’s not quite that simple – but most of these companies are

profitable at $500 gold. Why have they lagged gold for the past few

months?

There are a variety of reasons, but the main one is that institutional

investors (think mutual funds, pension funds, hedge funds) are taking

profits on their gains of these 16 gold companies.

Why are they taking profits? Who knows. They might think that the gold bull

market is long in the tooth. Or they might be covering losses from other

sectors. They might simply be rebalancing their portfolios to not be as

gold heavy. Or maybe they’re selling gold stocks and buying gold. We can’t

know why they’re selling.

But if you’re a long term gold bull, (as I am) then you should be looking

at this underperformance in the gold majors as a buying opportunity.

My colleague Jason Cimpl is taking advantage of this opportunity.

Yesterday, he released a brand new research report on the five precious

metals stocks to buy today. You can read all about this report by clicking

here now. It’s called

Top 5 Gold and Silver Trades for Summer

2011.

Jason is a technical analyst by trade, and he’s looking at gold and silver

on that basis. He thinks precious metals stocks will outperform for the

rest of the summer.

For me, I think that anytime you can buy the largest “blue-chip” type

companies in a given sector at a discount to their fundamental trend, you

should back up the truck. And my long term thesis is that gold and silver

will likely double or triple in price before this bull market in precious

metals is over.

So the wind is at your back, and with Jason’s technical prowess, you know

you’re getting a good buy price for gold.

I hope you’ll take a look at Jason’s research. It’s the type of

to-the-point investment research that can really cut through all the noise

in the market.

Facebook

Facebook

Twitter

Twitter