-

How to ‘paperweight’ your bottom

dollar - Buying the Dow at a PE under 7

- Gold $5000?

Gold and I are close – but I have no illusions about its

usefulness or role in my portfolio. It’s a store of value and a medium of

exchange – though admittedly more the former than the latter at

present.

Its ability to preserve wealth is unparalleled while the broad market remains

bearish. I’ll never sell all of my gold or silver, because as my

younger sister Beth says, they’re very effective paperweights.

She meant the

remark as a slight against my ‘foolish’ choice to buy physical gold and

silver – but I agree with her in one respect: gold and silver do an excellent

job of paperweighting your last bottom dollar no matter how windy the markets

get…

That being said, I am peeking over the horizon for a time

when I will gladly sell most of my gold and silver to load up on an

investment that’s historically been the greatest generator of wealth and

profits in world history: the broad stock market. More specifically, I want

to buy the 30 companies in the Dow Jones Industrial Average index.

But I don’t want to

buy today, with a trailing average PE of 14.34. I’m more interested in buying

the Dow near all time lows – like when it sold for between 6.88 and 7.59 in

1980-1982. Of course valuations can be tricky, so I’ll use the relative value

of gold during that time as a more effective goalpost.

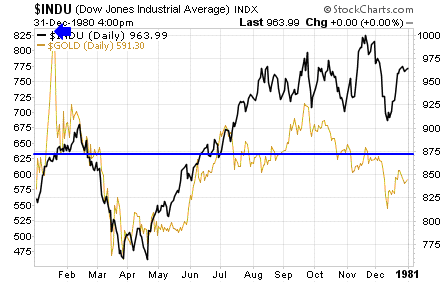

That time period coincided with record inflation adjusted

highs for gold – and for a moment in January of 1980, the Dow and gold traded

very close to nominal parity. In the third week of January, gold briefly sold

for $850 an ounce, and the Dow index was at about 870:

Today, there’s a variety of analysts and prognosticators

predicting just about every possible dollar value for gold and index number

for the Dow.

One of the most respected (and accurate) is Charles Nenner.

Mr. Nenner looks at huge macro trends in the broad stock market. He

accurately predicted the 14,300 point high for the Dow back in 2006. Then in

December of 2007 he predicted the market would crash.

Today, Mr. Nenner is looking for the Dow to dip close to

5,000 sometime in the next few years.

Will this be

another chance for gold to come close to parity with the Dow? Maybe, but it

would mean that gold will be selling for close to $5,000 an ounce.

And if so, I’ll look at this crossing of these stars as a

time to ditch gold and silver and move into the Dow. The last time it

happened (in 1980), every dollar invested in the Dow was returned 12-fold

over the following two decades. That presents another problem; when to sell

the Dow. But I’ll cross that bridge when I get to it.

In the meantime, I’m still buying gold and silver. Right now

I’m starting to put together a comprehensive report on exactly how to buy AND

sell precious metals. My report should be done in the next month or so – but

if you have any specific questions or comments on the process, please send

them my way at editorial@resourceprospector.com.

Good investing,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook

Twitter

Twitter