- Deflation or inflation?

-

Are precious metals good deflationary

investments? - It’s counter intuitive, but…

I’ve flirted with the idea of dedicating each Friday’s

edition of the Resource Prospector to more humorous

topics. But it’s tough to be appropriately reverent about something as

serious as our money while at the same time being humorous.

And to be honest, not many of the current topics in the

resource sector are especially hilarious.

For instance: there’s currently some degree of argument over

whether we’re currently experiencing inflation or deflation. I can’t think of

a more non-funny topic. If they say that comedy = tragedy + time, or that

comedy is tragedy that happens to someone else, then it doesn’t seem like

there’s much opportunity for jokes. After all, deflation or inflation is

happening to all of us all of the time, so no matter how tragic it is now,

it’s likely to be at least as tragic later.

Oh well, maybe I’ll find something appropriately funny for

next week. In the meantime, if you have any good jokes based on economics,

investing or politics, feel free to send them my way:

[email protected]

On the topic of

inflation vs. deflation:

I haven’t seen prices drop – and according to the Bureau of

Labor and Statistics’ own Consumer Price Index, prices across the board for

2010 have been flat to slightly higher through June 30th.

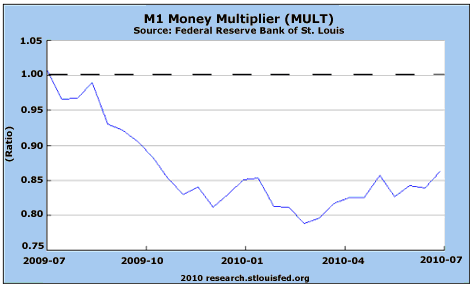

Another measure of inflation/deflation is the velocity of

money – measured most broadly as the Federal Reserve’s M1 Money

multiplier:

This chart shows the speed at which money flows through the

economy – and right now, money simply isn’t flowing from the Fed through

banks and into the marketplace. That’s a deflationary signal.

I firmly believe that the Fed is in a suicide pact to

prevent deflation which will eventually result in epic inflation – but until

then, we’ll likely see some mild deflation.

But let’s assume the worst case scenario – that I’m

completely wrong, and that

we’re in for many long years of deflation, not inflation, and prices will

fall, not rise. Maybe Ben Bernanke re-writes his dissertation on the topic

and does a 180. Maybe he lands the helicopter and starts sweeping dollars

back into the Fed’s coffers.

How will silver and

gold hold up? If these two precious metals skyrocket during periods of high

inflation – it would simply stand to reason that they might catastrophically

plummet during periods of deflation. Right?

Well, fortunately for gold and silver investors, economics

is not a simple if-then Boolean logic problem.

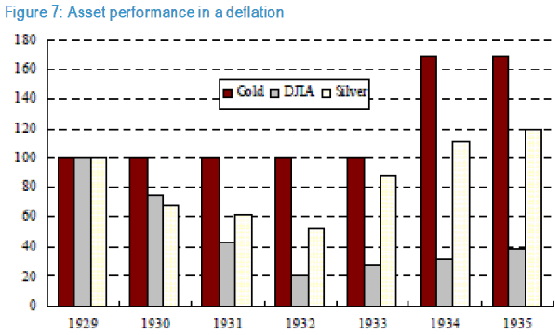

According to a recent study from JP Morgan (NYSE:

JPM) gold and silver both outperformed the broad market during the

Great Depression, one of the worst deflationary periods in US history:

Here’s the relevant quote from the JP Morgan report:

“The performance of silver gives us confidence that

precious metals are likely to outperform the general markets in a downturn.

In a really tough deflation, the absolute price levels of the metals could

weaken, even as they outperform most other sectors.”

I found another, older paper written by Sam Hewitt, a Ph.D

and Certified Financial Advisor. He wrote the paper in 1996 for a firm called

Sun Valley Gold Company – so it’s best to take his findings with a grain of

salt, but I found the paper to be useful in answering why gold and silver

might outperform during a period of deflation, when you’d expect the

opposite.

He says,

“In historic US deflations, individuals had the choice

between paper currency or gold as hoarding vehicles. The historical record

demonstrates that loss of confidence in the issuer of paper currency is often

a sufficient reason for individuals to choose gold over paper

currency.”

So, it’s precisely because people lose faith in currency

during deflation that gold and silver rise – or at least don’t fall as much

as other assets.

The problem with deflation, I’m sure Ben Bernanke would tell

you, is that people hoard capital, which has a chilling effect on growth,

wages and eventually prices. And when people think of hoarding, they tend to

think of gold and silver as good places to hoard capital.

It’s counter-intuitive. You’d expect prices of gold and

silver to fall, just like prices of every other asset. But it’s not the

case.

So, even though I’m “hoarding” gold and silver anyway

because I fear inflation, it’s good to know it will hold up even if I’m

completely wrong and that deflation is coming down the pike.

Have a great weekend,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook

Twitter

Twitter