I’m not supposed to give you free stock picks in this newsletter.

My bosses remind me that it’s better to tease investment ideas and trends and then upsell you to a paid product, than to just give away ideas in this free letter.

But frankly, it’s tiresome to constantly tease something, it’s not very fun, and I know you probably don’t appreciate it either.

So today, take my word for what it is: an honest and heartfelt plea to pay attention to gold stocks.

Why?

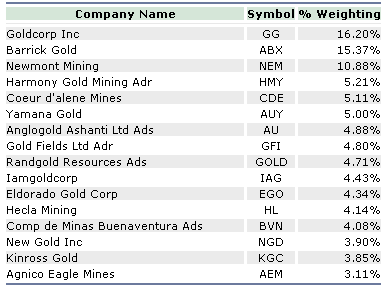

Well, let’s take a look at a 3 year chart of the Amex Gold Bugs Index (NYSE: HUI). It tracks the 16 largest publicly traded gold (and silver) companies – and is more or less a useful snapshot of the industry as a whole.

In red, I’ve blocked out a price range of what traders might call "high congestion."

There’s lots of support and resistance areas in between the two horizontal lines, and right now, this index of gold miners trades at the low end of that range.

Moreover, in the last week or so of trading, the index has resumed an uptrend after a multi-month bear trend:

So we’re close to two year lows, and we’re in the start of an uptrend. That’s about as good a buy opportunity you’re likely to find.

How should you play it? I’d suggest taking a closer look at some of the component stocks in the gold bugs index to find value plays. Look for low debt, low PE, and dividend yield as your guideposts.

How should you play it? I’d suggest taking a closer look at some of the component stocks in the gold bugs index to find value plays. Look for low debt, low PE, and dividend yield as your guideposts.

Bottom feeders will be rewarded handsomely during the next major uptrend in gold and silver.

Good Investing,

Kevin McElroy

Editor

Resource Prospector Pro

Facebook

Facebook

Twitter

Twitter