-

Gold still $1000 off its inflation adjusted

highs -

Gold stocks falling behind – are you

buying? -

20-100 per cent upside if gold stays above

$1100

“Gold Loses Some Appeal”

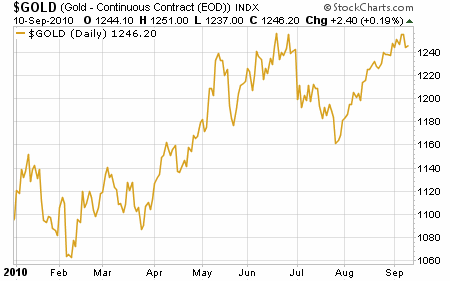

That’s the headline from a story in

The Wall Street Journal just a few days ago, on September

10, 2010.

Gold dipped 0.4% on the Comex division of the New York

Mercantile Exchange to $1,246.50 an ounce.

That’s still close to the dollar denominated high of $1265

reached in June.

I just bought some physical gold during the dip back in

July, and I do plan on buying during future dips – but I wouldn’t recommend

buying gold necessarily at this point.

Even though the

yellow metal is about $1000 off its inflation-adjusted highs of $2251 reached

in 1980, I hesitate to recommend buying physical gold at these levels.

The good news is that there are plenty of gold securities

you can buy that are still relatively inexpensive. That’s because gold stocks

tend to lag gains made in the price of the underlying commodity.

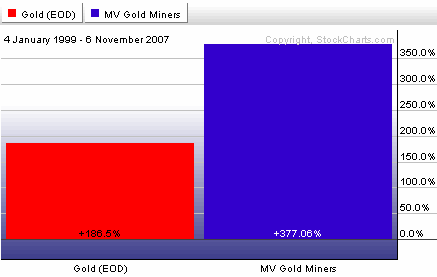

I’ve been repeating the above statement for many months now,

but it’s true. Here’s a chart showing gains made in the price of gold (in

red) vs. gains made in the price of the largest gold stocks (in blue) between

1999 and 2007.

You can see how the bull market in gold over this period was

magnified nearly two-fold in gold stocks.

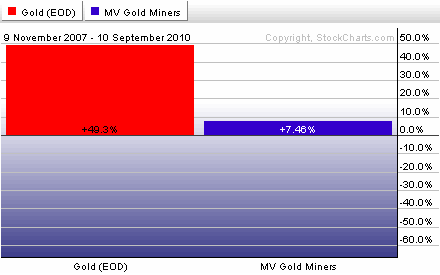

But since September

of 2007 gold stocks have been lagging gains made in the price of gold.

You can account for some of the under-performance by looking

at the huge sell-off in all stocks in 2008-2009. Since then, gold has nearly

doubled, while gold stocks are flat:

But $1200+ gold is hugely profitable for gold mining

companies. Most gold miners are profitable as long as gold is north of around

$600. That’s about the average amount of money it takes to mine and refine

one ounce of gold and bring it to market.

Anything over $600 is pure profit. That’s why gold miners

are able to multiply gains made in gold: their earnings go up by an

incremental factor over and above their costs of production.

A quick example:

If gold prices are $1000 an ounce, the average gold miner

makes $400 per ounce in profit. But if gold rises to $1200 an ounce, they

make $600 in profit, or 50% more! Gold rose 20%, and gold miners make 50%

more profit. That profit is eventually reflected in the stock price, but

there’s a lag.

The lag can be accounted for because of two reasons: it

takes time for gold miners to increase production to take advantage of

increasing prices, and most fundamental analysts (the guys who set price

targets on Wall Street) determine a stock’s price target based on the present

value of future cash flows – the stocks will move higher once these

increasing future cash flows become more reliable.

What’s the downside?

Gold miners take a commensurate hit when gold prices slide.

That increased profitability (future cash flows) can just as easily turn into

decreased profitability (lower future cash flows), and gold stocks tend to

get punished accordingly.

So, the trick is to find companies with the lowest

costs-per-ounce, and to buy them on dips after gold falls.

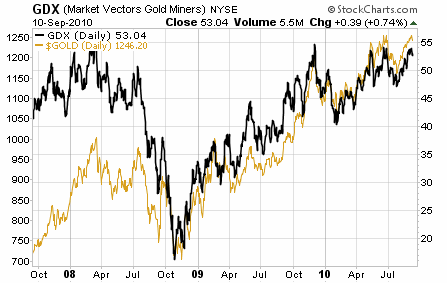

Right now, gold

stocks are severely lagging the gains made in gold’s price. If gold stays

above $1100, I expect gold stocks in general to move at least 25% in the next

six months. That’s not speculation, it’s simply where gold stocks should be

to catch up to gains in gold’s price. If they multiply gains in gold’s price

– as they typically have done over the past 10 years, then you’re looking at

a potential 100% gain, or a double.

That’s just the average gain. You can shoot for average by

simply buying the Market Vectors Gold Miners ETF (NYSE:

GDX). This ETF is comprised solely of the largest publicly traded

gold mining companies.

If you’re interested in an investment with a little more

upside, then I’d recommend taking a look at a company Chief Investment

Strategist Ian Wyatt recently added to his Small Cap Investor

Pro portfolio. It’s a small North American gold mining company

with one of the lowest costs-per-ounce of any gold miner: around $450.

But right now this company is trading at a substantial

discount to its gold reserves. Buying them today is like buying their gold in

the ground for less than $200 an ounce. Like most publicly traded gold

companies, they’re lagging gains made in gold’s price. Gold made 15% gains so

far this year, but Ian’s favorite gold stock is actually down 5%.

It’s a great time to be buying low cost gold producers.

You

can click here to read the rest of the story.

Good Investing,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook

Twitter

Twitter