- Why I’m still long gold

-

Only 27 years left for Social

Security - The ugliest flow chart

- Two questions you must answer

There are literally

trillions of reasons to be bullish on gold – but I recently received a letter

from the Social Security Administration (SSA) that further cemented my belief

in the uptrend for gold (and silver).

In a letter titled “Your Social Security

Statement” the Commissioner of Social Security Michael J. Astrue

wrote:

“…by 2037, the Social Security Trust Fund will be

exhausted and there will be enough money to pay only about 76 cents for each

dollar of scheduled benefits. We need to resolve these issues soon to make

sure Social Security continues to provide a foundation of protection for

future generations.”

I’ve done the calculations, and I now pay about 7% of my

income in FICA taxes, an amount I realize also includes Medicare – which is

of course, matched by my employer. So, that’s 14% of my potential income

gone. It’s more than I currently save for my own retirement.

I’m outing myself here, but everyone pays about 7% of their

income into FICA, unless they make over $106,800 a year.

My point is this: the program isn’t going anywhere because

almost everyone pays out a big chunk of their paycheck every year, and

they’re banking on getting their “entitled benefits” upon retirement. That’s

how FDR set it up 75 years ago. He knew that once people had the money

forcibly taken from them, they’d expect to get something back.

But even by the

rosy estimates of the SSA, they’ll only be able to pay these benefits in full

for the next 27 years. I’m guessing that Mr. Astrue thinks that people my age

will look at this information and come to the conclusion that we have to put

more of our money into the SSA fund, to make sure there’s enough for us when

we retire.

So, we’re going to find out what happens when an

irresistible force (raising taxes) meets an immovable object (cutting Social

Security). One or both of these scenarios has to happen (and soon!) in order

for the SSA to continue to pay regularly scheduled benefits for the

foreseeable future.

I don’t foresee anyone in Congress putting forth a bill that

will raise FICA taxes OR cut Social Security. Either one of these proposals

would be election suicide.

My estimates for Social Security benefits are somewhat less

rosy – if the fund makes it to 2037 I’ll eat my hat. This year, for the first

time since the recession of the early 1980s, the SSA paid out more than it

took in.

But the situation has very little in common with the 1980s.

We have much higher government debt, less personal savings, more unemployment

(in real terms) and less control over the world’s resources than we did back

then.

Okay, so if Congress is too cowardly to raise taxes OR cut

Social Security, what will have to happen?

Simple. The Federal Reserve will print the difference, and

deposit it with the Treasury. In fact, it’s already happened, basically. You

might not realize it, but much of the Social Security Trust Fund is already

invested in US Treasuries. It’s a roundabout way for the government to tap

into this “separate account” and move it to the Treasury’s balance

sheet.

Sure, they have to pay the Fund back with interest, but that

interest comes from the Treasury via new purchasers of US Treasury

debt.

One of the biggest holders of US Treasury debt today is the

Federal Reserve. Last year, the Fed bought 80% of the Treasury’s $1.5

trillion in issued debt.

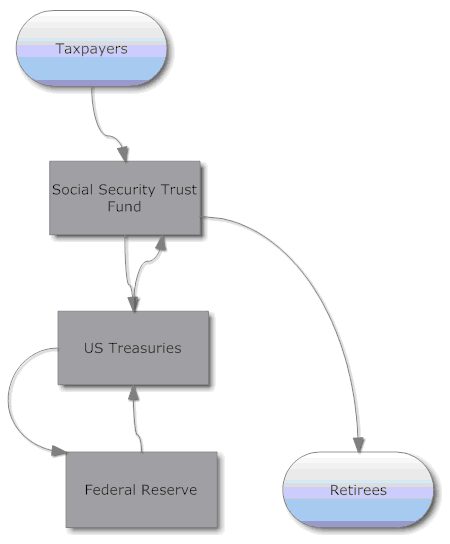

So – I’ve

constructed a rudimentary flow chart:

It’s a little confusing, but in essence, the Federal

Government is borrowing money from the Social Security Fund, and paying it

back with dollars from the Fed. Where does the Fed get those dollars? I’ll

give you a hint: they didn’t exist until the Fed gave them to the Treasury –

so they created them out of thin air.

Of course, Social Security is just one substantial tip of

the iceberg. There are plenty of other “entitlements” and government programs

that require the assistance of the Fed’s printing presses for their funds.

There’s some we don’t even know about.

So you have to ask

yourself two questions:

1. Is it likely that the Government will slash these

programs or substantially raise taxes in order to keep the gravy train

rolling?

AND

2. What will happen to the dollar as these obligations are

increasingly met by funding from the Fed?

To me, the answers are painfully obvious. And I’m buying

gold and silver.

Good investing,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook

Twitter

Twitter