If it was a snake, it would bite you. This massive and sustained correction in precious metals prices is what we call a “buying opportunity” in the business.

I know I’ve been as regular and sustained as a metronome in my constant “buy gold” calls for much of the past 3 years (with a few notable exceptions when I pointed out that a gold correction was imminent) – but if you’ve been waiting, or you just haven’t gotten around to buying gold or silver lately, the opportunity to buy has rarely been better during this bull market.

When I say, “rarely been better” I’m not referring to better prices. Prices were much better 32 years ago.

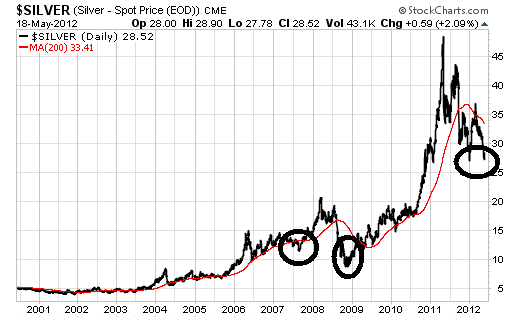

I’m talking about a real sustained price correction – a time when the market over-corrects to the downside. We haven’t seen too many of these opportunities. And when they come, we should be buying.

Gold has only fallen significantly below the 200 day moving average 3 times during this bull market – and both of the other times preceded huge gains.

The story for silver is similar.

If you’re not buying during these market down turns, then I firmly believe you’re missing out on the single best times to buy during this bull market.

On the other hand, if you’re selling right now, you’re selling at the worst possible time. That’s the nature of most bull markets though. Even people who are right on the trend, tend to sell at the worst possible times – and buy back in near the top.

If you’re typically one of these people, ignore your instinct to sell now. Wait a month or two. I think you’ll get better prices.

Facebook

Facebook

Twitter

Twitter