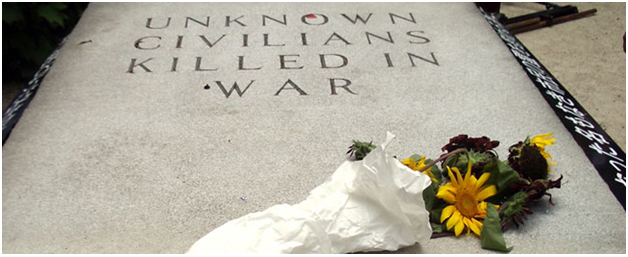

A war has raged for about 70 years.

The soldiers aren’t members of any country or tribe. The casualties (as in most wars) are innocent civilians.

On one side, we have people who believe they (and they only) have the authority and ability to design and control complex economies. When (not if) their tactics fail, they claim they don’t have enough power. These people believe they can never be wrong, only that they need more power, more money, more regulation, more taxes, more spending.

They claim to “know” the cure for any problem. Everything from recession, depression, unemployment low stock prices, trade deficits, pension failures – every problem, they believe, is easily cured by printing and/or spending money.

They see the economy as a ship that can (and should) be steered. And they’re currently in control of every major central bank in the world. They’re what you might call “Keynesians,” and they’ve been in control for much of the past 100 years.

On the other side, you have a handful of people who believe that economies are complex systems which can no more be effectively controlled than you or I could effectively count rain drops during a thunderstorm.

They believe that no person or group of people can manage such a complex system of buyers, sellers, producers, consumers, creditors, and debtors.

They believe that the money printing and government spending makes the market’s problems worse, not better. They believe that the market is the best mechanism for providing vital goods and services.

They want no control over the economy. They desire no oversight or central bank fiddling. The price of money, they believe, should be controlled by the market, in the same way that the price of corn or gold is tied to the market’s price mechanism.

They believe in voluntary trade between willing people.

They believe that the “cure” for unemployment is LESS government spending, less taxes, less money printing and less regulation.

They believe that only consumers can know what and how much to consume. Only producers can know how much or what to produce. Only savers know when and how much to save.

They see government intervention and central banker tampering as the CAUSE of the business cycle and the severe depressions that follow.

And they’d like to see you given back the monetary freedom that’s been taken by the Keynesians.

Unfortunately, if you plan on voting for Mitt Romney or Barack Obama in the upcoming election, you’re voting for a Keynesian.

These two candidates do not believe in free markets. They do not believe that you should have monetary freedom.

But what we know about Keynesian currency systems – and all fiat currencies – is that they eventually fail. No matter who wins the Presidential election this November, our next president will likely witness some of the final death throes of the dollar.

And it won’t be pretty. The Keynesians, as I said, don’t take failure easily. They always grab more power. They always wrest more control. They always print more money.

Invest accordingly – and avoid being a casualty in this war.

Facebook

Facebook

Twitter

Twitter