-

The price of oil isn’t the best

indicator - The exception to the rule

-

Three companies to buy today and hold

forever

It’s tempting to look at the price of a barrel of oil, or

the price of a gallon of gasoline as a way to evaluate when oil companies are

cheap.

But there’s little

correlation between oil price and profitability, value or future share price

for most of the companies in the oil sector. There are a few exceptions that

I’ll talk about in a minute…

Not to go into too much detail, but most oil companies,

large and small, hedge their production in the futures markets. When you

hedge your production, it has the effect of evening out the highs and lows in

the market.

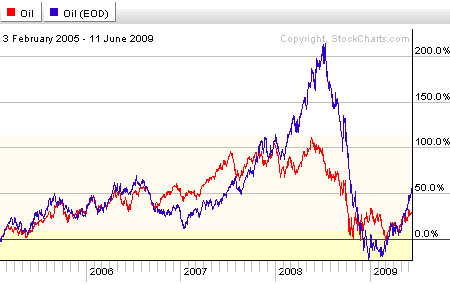

You can easily see the effect of hedging by looking at two

charts stacked on top of each other: the percentage performance of a price of

a barrel of oil plotted with the percentage performance of the AMEX

oil index (AMEX: ^XOI).

The AMEX oil index compiles the price movement of the 13

largest publicly traded oil companies. And no, you can’t buy it –

unfortunately it’s not a traded index.

As you can see, the price of oil (in blue) tripled between

2005 and mid-2008. But the index of the 13 largest oil companies (the red

line) only doubled.

Then again, when the price of oil retreated below 2005

levels, the return of the oil index stayed positive.

Of course there are other reasons why oil companies tend to

be less volatile than oil prices, but the point stands: I’d caution anyone

from looking at oil prices as a way to know when to buy or sell oil

companies.

There’s an

exception to the rule.

One sector of the oil industry DOES correlate strongly with

changes in the price of oil. Many companies in this sector even manage to

outpace gains in the price of oil…

I’m talking about oil services, and more specifically,

deep-sea drillers.

The reasons these companies typically make much higher

profits when oil prices are high is that they’re incentivized to do so when

prices are higher. That’s when oil companies that require their services need

them to work around the clock to bring oil to market.

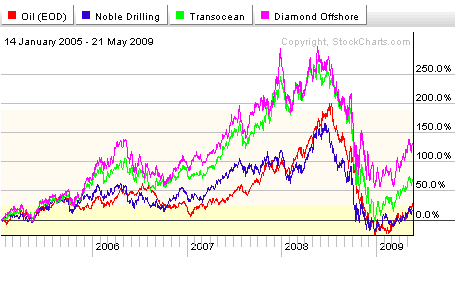

We saw these companies skyrocket much higher on a percentage

point basis than the price of oil, even as the large blue-chip producers

didn’t come close to matching gains.

Here, I’ve plotted the price of oil (in red) vs. three of

the biggest offshore drilling companies: Noble Drilling (NYSE:

NE) in blue, Transocean (NYSE: RIG) in green and

Diamond Offshore (NYSE: DO) in pink.

You can see that Noble Drilling trades in very close tandem

with the price of oil, and Diamond and Transocean seem to do a good job of

multiplying gains in the price of oil.

The reason I bring

this point up now is that oil prices are currently stuck in a trading range

between $70 and $80. This trading range is dependent on many factors,

including oil inventory, oil reserves, the strength of the world economy,

etc.

But the point is – it won’t last. We’ll see much, much

higher prices in the next 12 or so months – and higher prices still in the

years to come – for a simple reason: the world is running out of oil at an

astounding rate, while growth in Asia is increasing demand at the same

time.

When those higher prices arrive, these specialized oil

services companies should see major stock price appreciation.

I’d recommend picking up shares of all three. My favorite

one of the bunch right this minute happens to be Diamond just because it’s

the cheapest relative to its earnings – but I do plan on picking up shares of

all three over the coming months.

As always, do your own due diligence to find the company

that’s right for your portfolio, but I believe the oil services sector is one

of the most potentially profitable in the stock market today.

Good investing,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook

Twitter

Twitter