- My favorite corn company

-

16% revenue growth in the last quarter

alone… -

A 48 year history of raising their

dividend

Today you can buy a 10-year Treasury bond and get a 3.11%

yield – but wouldn’t you rather own shares in a company that pays a better

yield, and has the potential to increase in share price?

I usually try to find companies that benefit directly from

higher commodity prices, but in this case, I’ve found a company that could

benefit despite higher commodity prices…

This company pays a

3.4% dividend – and better yet it has the ability to raise or lower prices at

will. That’s because it takes one of the cheapest commodities on the planet

(corn) and turns it into an easily consumable good – with a price markup in

the triple digits. Whether you believe we’re headed into deflation or

inflation, pricing control is hugely important.

More on this pricing control in a minute…

Most people buy Treasuries precisely because they want

safety.

If you’re worried about safety, I’d make the argument that

buying shares of Coca-Cola (NYSE: KO) today is at least as

safe as buying a 10 year Treasury. Whereas Coca-Cola has less than $12

billion in debt (about 1/3 of its total annual revenues) the U.S. Treasury

has to fund something close to $13 trillion in the next 10 years, – which

amounts to close to 80% of its revenues over that period – but that doesn’t

account for continued deficit spending…

You might make the argument that the U.S. Treasury can

always have the Federal Reserve print more cash to meet its debt obligations,

but Coke can do the same thing by issuing new shares. Both scenarios assume

there are willing buyers of course.

Besidesthe massive

debt obligations, Coke has something else that the Treasury can’t boast:

Coke’s revenues are growing. According to

The Wall Street Journal today:

“Aggressive marketing during the World Cup gave Coca-Cola

Co.’s namesake soda a boost in the second quarter, driving sales in markets

from the U.S. to Brazil and pushing profit up 16%.”

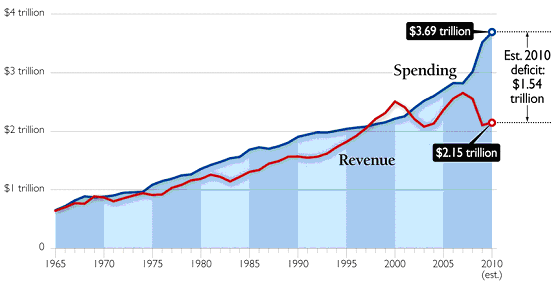

Meanwhile, U.S. tax revenues fell precipitously last year,

and they haven’t quite recovered…but that hasn’t stopped Federal spending.

The estimated deficit for 2010 is over $1.5 billion:

So how is Coca-Cola able to control its pricing? As I said,

their business model is based on taking corn, one of the cheapest and most

readily available commodities on the planet, and turning it into an easily

consumable product with a triple digit markup.

Corn costs approximately 6.5 cents per pound. Of course,

Coca-Cola doesn’t have raw kernels floating in its beverages. The company

sweetens carbonated water with high fructose corn syrup, which currently

costs about 26 cents per pound.

But those 26 cents let the firm manufacture approximately 10

bottles of Coca-Cola. So each bottle of Coca-Cola has less than 3 cents worth

of sweetener – but you’ll pay at least $1.25 for a 16 ounce bottle.

The other inputs to the product (carbon dioxide, water, food

coloring) are at least as cheap. The plastic bottle, at approximately 85

cents a pound might be the most expensive part of the manufacturing

process.

Of course, Coca-Cola also has to pay for distribution – but

it’s still somewhat vertically integrated. You might recall that Coke split

off the bottling portion of its business into a separate corporation called

Coca-Cola Bottling (NYSE: COKE). The bottling wing is still

31% owned by the manufacturing wing.

So, this company is still basically intact as the closest

thing to a legal-monopoly. I fully expect corn prices to rise, but it won’t

matter for Coke because they have the ability to raise prices at will. Corn

syrup and other sugar prices could quadruple, and it might wipe out smaller

players in the soda sector, but Coke won’t be going anywhere.

Heck, the company puts plain water in a bottle (it owns

Dasani), and people buy cases of the stuff.

Coke’s one of those

companies that’s going to be around no matter what happens in the broad

market. Like I wrote in my article on Budweiser (NYSE: BUD)

you couldn’t design a better company from scratch. Coke has worldwide brand

recognition, fierce customer loyalty, great marketing, pricing power, and

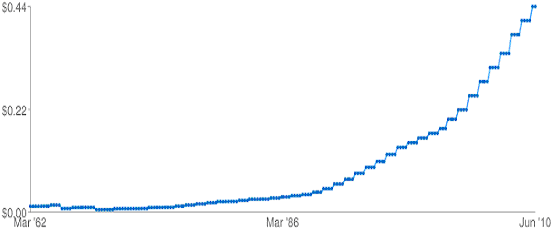

even a history of raising its dividend.

I mean, look at this chart showing the company’s dividend

growth going back to 1962:

I love this company under $55, because you’re locking in the

dividend at more than a 3% yield; which is better than a 10 year Treasury.

There’s been strong support at the $50 level, but if you get a chance to buy

this company at that price, I’d back up the truck.

The bottom line: corn is going to go up in price, and that

will only help Coca-Cola.

Good investing,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook

Twitter

Twitter