- A gold metal for boom times

- Warehouse stocks are falling…

-

The investment with 30 percent upside this

year

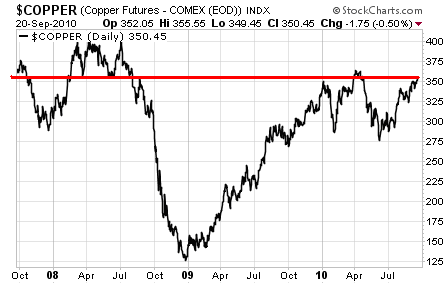

Today I want to talk about a metal that gets little love or

attention in the mainstream media – until it dramatically increases in

price.

I know you’ve heard such claims before – but I’ve been

scouring the headlines of major news sources, and no one is talking about

this metal, even though its price is scratching highs not seen since

2008.

I’m talking about

copper – a metal associated with boom-time construction. Every new building

on this planet needs copper pipes for plumbing and copper wire for

electricity – at the very least.

So…if housing is still in the toilet, and commercial real

estate is still circling the drain, why would copper prices keep surging

towards pre-recession highs?

It’s quite simple, really.

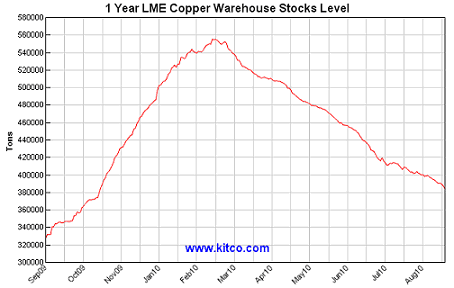

Copper stocks

(physical inventories of copper, not the stocks of copper mining companies)

are falling to levels not seen since early Q4 2009. Here’s a chart showing

copper warehouse stocks at the London Metals Exchange over the past

year:

Couple this dwindling supply with slowed, but quite robust

growth in Chinese construction, and you have a recipe for higher

prices.

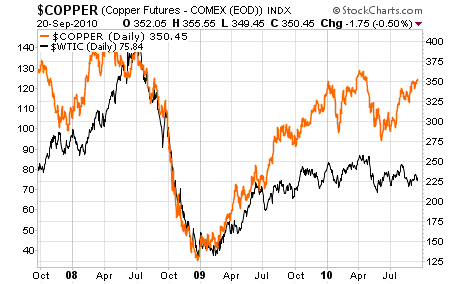

Yesterday, I talked about how rising oil prices will set a higher floor

for all commodities – independent of inflation. Copper is no exception. It’s

at least as oil intensive to bring it to market as most other commodities.

Looking at the chart below, you can see that oil and copper tend to trade in

tandem:

So, I expect higher oil prices to contribute to a price

floor on rising copper prices.

And I’m (thankfully) not the only one talking about copper.

It’s true that the mainstream media isn’t interested, but there are plenty of

folks out there beating the drum for copper.

Let’s be clear: copper will never be as sexy as gold, no

matter how high its price goes. But some of the same folks who were talking

about gold prices climbing earlier this year are now shouting the same

message regarding copper prices.

I’m no fan of

global banking firms, but I’ve been pleasantly surprised at the solid

analysis coming out of Credit Suisse (NYSE: CS).

In June of this year, the Switzerland based banking

conglomerate predicted that gold could rise to $1,500 by the end of

2010.

With gold hovering around $1,270 that’s still somewhat of a

bold prediction, but Credit Suisse analysts made this prediction at a time

when gold was selling for nearly $100 cheaper.

Recently, Michael Shillaker a metals and mining analyst at Credit Suisse predicted

a 30 percent upside for copper miners by the end of 2010, with as much as

100% gains possible over the next two or three years.

It’s good to know I have some

institutional backing – and I’ve recently recommended that my readers pick up

shares of one of the largest copper miners on the planet:

Freeport McMoran (NYSE: FCX). In fact, I

did so just days after Mr. Shillaker made his bold prediction for copper

miners.

(You can read my Sept. 1 article about FCX by

clicking here.)

Since my recommendation, shares have moved 9% higher. I

don’t know if this company will surge another 21% to round out Mr.

Shillaker’s prediction, but I’m not interested in “trading” shares of this

company over the short term anyway – in fact, I like this company as a

long-term play on sustained higher prices for copper as well as gold (it

mines both).

As long as I’m bullish on these metals, I like shares of

Freeport McMoran under $80 a share. That’s a bit lower than where the stock

trades today so look for opportunities to buy the dips. As always, do your

own research before pulling the trigger.

Good investing,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook

Twitter

Twitter