Whether you’re a novice investor or seasoned trader, there is a single rule that can separate you from most investors.

During my days on Wall Street, I’ve watched experienced floor traders lose their shirts by ignoring this investment covenant.

The best part is that following this powerful rule will result in bigger profits and fewer losses. And every investor can easily put this into action. If you’re a long-term buy and hold investor or an options trader, this one rule can make all the difference between your investment success and probable failure.

This is the rule of “mean reversion.”

Now that may sound boring…but let me quickly explain this in the most simple of terms.

Mean-reversion simply put, is the idea that a security’s most extreme moves (up and down) will eventually reverse, and move back towards the average. The more extreme the move, the more likely it will reverse.

The best part is you can actually measure the extremity of the move, and then profit with a huge degree of reliability by simply investing on the likelihood that the extreme move will reverse.

I always teach investors to make decisions based on probabilities. If you do so, you’ll make money over the long term.

Let me share a recent example to highlight the importance of mean reversion. After all – even if you’ve never traded or used stock options – this all-important rule can help you better time your purchase of stocks for the long-term.

Apple (NASDAQ: AAPL) shares have been on the rise recently.

In fact, the tech behemoth shares jumped more than 5% in the last week.

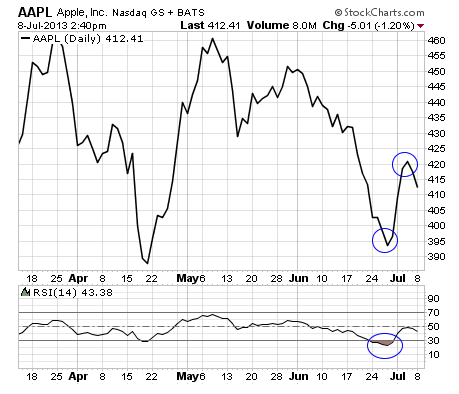

As you can see in the chart below, Apple shares took a dive during the month of June.

But for most professional investors and options traders, the sharp decline was a blessing.

Why?

Because most options traders – myself included – are contrarians at heart.

As award-winning journalist and investor Jason Zweig recently wrote, “my role, therefore, is to bet on regression to the mean even as most investors, and financial journalists, are betting against it. I try to talk readers out of chasing whatever is hot and, instead, to think about investing in what is not hot. Instead of pandering to investors’ own worst tendencies, I try to push back. My role is also to remind them constantly that knowing what not to do is much more important than what to do.”

Thank you Jason, I couldn’t have said it better.

The sharp sell-off pushed the stock into a short-term oversold extreme (as seen by the circled RSI reading in the chart). And this is exactly what I look for everyday – highly liquid stocks and ETFs that are at short-term oversold/overbought extremes. Once these extremes enter my universe, I implement one of several strategies (I speak about this in great detail in my latest webinar).

With the recent Apple scenario, the stock quickly became oversold. So I made the assumption that the shares would move higher, at least over the short term (1-5 days). Therefore, I used a bullish options strategy – also known as a Bull Put spread.

The goal of a bull put credit spread is to have the stock close ABOVE the short put strike sold at options expiration, the third Friday of every month…in our case $345.

If that occurs, the puts expire worthless and I keep the credit received up front.

Basically, as long as APPL closes above my chosen short strike of $345, roughly 15% below the current price of the stock, the trade is profitable. The return on the trade… 11.1%, and that’s in less than 30 days.

I can’t go into too much detail in this forum – but I encourage you to watch my latest webinar (for free) to get a closer look at this specific trade.

Mean-reversion coupled with a high-probability strategy like the Bull Put spread is a combination professional options traders have been using successfully for years. Due to advances in technology we now have the ability to take advantage of these same conservative, high-probability strategies.

It is my goal to help you understand some of the more effective ways to enhance your portfolio returns and not use the highly speculative methods that have been touted over the years.

Kindest,

Andy Crowder

Editor and Chief Options Strategist

Options Advantage and The Strike Price

Facebook

Facebook

Twitter

Twitter