In last week’s article, I revealed a unique technique self-directed investors use to safely generate regular 8%-12% income streams on their retirement savings.

In a yield-starved environment, this strategy has been a blessing.

The strategy is called “selling covered calls.” If you aren’t using this strategy … well, you’re missing out on THE most revolutionary income strategy in the investment arena.

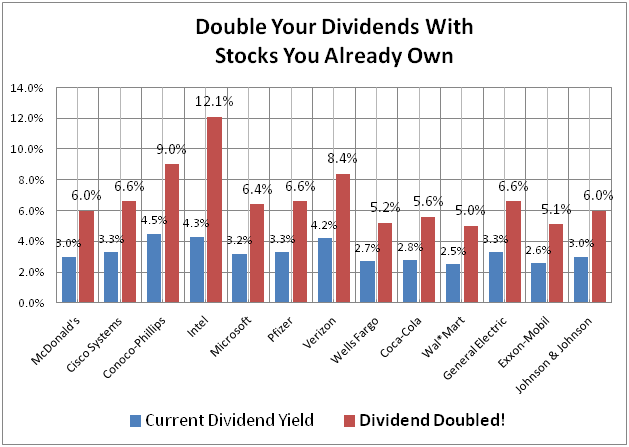

Over the past year alone, this income secret could have doubled your dividend payouts on some of the best stocks in the market.

The good news is you can still use this investment today. It’s not the type of opportunity that you can miss out on – because it’s based on the quality stocks you probably already own.

(Again, if you are not aware of this revolutionary strategy, I highly recommend you attend our upcoming FREE teleconference and ask a few questions next Thursday, April 25th at 2 PM.)

Today, I want to show you just how powerful this strategy works.

Let’s use one of the most popular dividend stocks in the market … Intel.

Intel is a well-respected, shareholder-friendly company that dominates its industry. The company has reliable cash flows and pays consistently rising dividends. Simply stated, it’s one of the steadiest stocks in the market and that is exactly what we are searching for when employing a covered call strategy.

It is imperative that we use the world’s safest and most reliable blue-chip stocks.

I can’t emphasize this point enough: when it comes to selling covered calls I only use stocks that are well-respected, shareholder-friendly and with a history of paying consistently rising dividends.

So let’s get back to Intel.

Right now you can collect an extra 2% in income every quarter in addition to the regular dividend payout (which right now is above 4%) – just by being a regular shareholder.

Added up, that comes to an additional 8% in income for the year for a total yield of more than 12% – essentially tripling your dividend payout.

Let me briefly show you a few numbers, so you can plainly see how useful covered calls are for safe, steady income.

Let’s say you own 100 shares of Intel, which is currently trading for $21.50. You can sell a call option that gives the buyer the right to buy your shares for $23 at any time over the next 93 days. For this privilege, you collect $0.44 per share, or $44, for selling that right. This $0.44 payment represents an instant 2.0% yield on your investment.

If Intel rallies above $23, you would be obligated to sell (for a 7% gain) your shares for $23, but you keep the $0.44 you got for selling the call. The $44 in income that you brought in at the onset is yours to keep. You never have to give it back.

Now if Intel isn’t trading above $23 by the time the option expires in July, you can do the same or similar trade all over again.

And just think …you can do this 2.0% transaction four times in one year for an extra 8.0% while collecting Intel’s safe 4.2% regular dividend. That’s triple the dividend for using this simple and reliable strategy.

On a $10,000 stake, that would generate more than $1,213 each year. That’s well above the yield for a typical blue-chip dividend stock. More importantly, it’s the type of income yield that you can actually depend on and use in this low-yield world.

Of course, this strategy takes a little bit more work than what you might be used to. But as many self-directed investors have discovered, it’s simple to learn … and simple to use once you get the hang of it.

Kindest,

Andy Crowder

Editor and Chief Options Strategist

Facebook

Facebook

Twitter

Twitter