I came across a few interesting statistics recently.

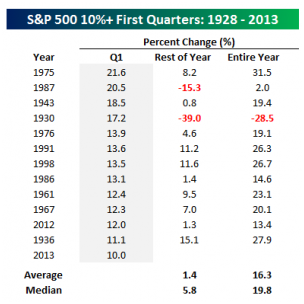

The 10% first quarter advance in the S&P 500 marked the 13th time since 1928 that the index gained 10% or more during first three months of the year.

How did the market fare after exceeding its average annual returns in just one quarter?

The wonderful folks over at Bespoke Investment Group published the following chart that provides some insight into what we should expect going forward.

As you can see the average gain for the rest of the year is limited at 1.4%. The median gain is not much higher at 5.8%. In fact, only once did the return during the next three quarters exceed that achieved in the first three months.

Even if we take out the huge down year in 1930, the average three-quarter gain is around 5%. So there’s little doubt that gains after the first quarter are muted at best.

Knowing that we could be entering into a potential lull, how can we use a portion of our portfolio to protect and drive income over the next nine months?

Credit spreads.

It’s a simple and straight-forward concept that I will be discussing in my upcoming webinar tomorrow at 12PM ET. Click here to sign-up. (If you are not able to attend … don’t worry. I will send you the video shortly after the event to watch at your leisure.)

Credit spreads, more specifically bear call spreads, allow you to create your own income – a monthly paycheck, if you will – while protecting against potential market declines . How? When you sell a credit spread, you collect cash (credit) up front while simultaneously transferring risk to the buyer.

Best of all, you can create your own income targets when selling credit spreads. And the sum of all of your so-called targets – when set properly – gives you a targeted monthly income.

Let me explain using a recent investment in Apple (I will be discussing an Apple trade in the upcoming webinar along with a few ways to protect your portfolio).

A bear call spread is a credit spread composed of a short (sold) call at a lower strike price and a long call at a higher strike price. The nature of call pricing tells us that the higher-strike purchased call will cost less than the money collected from the lower-strike sold call. That’s why this spread involves a cash inflow, or credit, to you.

The ideal outcome is for the underlying stock price to stay below the strike price of the sold call through option expiration. In this case, the spread expires worthless, allowing you to keep the premium collected upfront.

The basic premise of the strategy is easy. You choose the probability of the trade. Increasing the probability of success will decrease your potential profits, and vice versa.

Getting back to Apple, I’m sure most of you remember when the stock surged above $700 back in mid-September 2012. Amid the excitement, analysts were calling for the shares to race to $1,000 by yearend. I, on the other hand, noticed the stock had pushed into a “very overbought” state. As a result, I thought the shares were well overdue for a pullback, at least temporarily. (The same exact situation is happening in the S&P 500 right now)

So with Apple trading at $690, I chose a short strike for my bear call spread that met my risk/return objectives.

Because I prefer a win rate – or probability of success – in the 70%-95% range, I invested in the Oct12 750/755 bear call spread. In other words, I sold the 750 call and bought the 755 call, with both options set to expire on the third Friday of October.

I also like to give myself a decent margin for error because it increases my probability of success. For this example, the 750 strike allowed for a $60, or 8.7%, cushion to the upside. In other words, Apple could have gained nearly 9% before October expiration and the spread still would have expired worthless, allowing me to keep all the credit.

The Oct12 AAPL 750/755 bear call spread met my expectations, bringing in a credit of $0.62, or $62 per contract.

As a result:

- The max gain on the trade – 14.2% (this is based on the margin required to open this spread)

- Probability of success – 86.6%

Apple would have to move above $750.62 for the trade to start losing value. As long as the stock price stays below $750.62 through October option expiration, the trade would be successful.

Nine days later I closed the trade for almost the max gain. A 10%-12% profit in less than two weeks on a fairly conservative trade … not bad.

Credit spreads are my favorite way to trade options, particularly selling verticals. It’s an extremely simple strategy to learn and arguably the most powerful strategy in the professional options traders’ tool belt. And I can use credit spreads as often as I like.

As always, if you have questions, feel free to drop me a line at [email protected].

Kindest,

Andy Crowder

Editor and Chief Options Strategist

Options Advantage and The Strike Price

Editor’s Note: If you would like to learn more about options and how you can generate steady income month in and month out… then consider taking a free, 30-day trial to our real money alert service, Options Advantage. You’ll discover exactly how our resident options expert, Andy Crowder, is using high probability trades to steadily grow a $25,000 real money portfolio. Every trade is executed for real… and readers are alerted instantly, so they can invest right alongside Andy. Click here to try Options Advantage, free.

Facebook

Facebook

Twitter

Twitter