The bears have dominated the Intel (NASDAQ: INTC) chart this year.

Sellers dragged the shares 28% lower from a $29 peak in five months. A 28% decline is a noteworthy development for any stock, much less the $112 billion technology behemoth that’s Intel.

Outside of Apple (NASDAQ: AAPL), which is in a different league at times, mega-cap stocks rarely move more than 10% over a six-month period. Unlike small-cap stocks, analysts follow big companies more closely and constantly revise financial estimates. This helps alleviate the type of share volatility associated with a 28% stock decline.

Furthermore, big companies are often too big to swing more than 10% at a time. After all, a 10% adjustment may be the equivalent of $15 billion in perceived valuation. Nevertheless, Intel shares swooned sharply from their high.

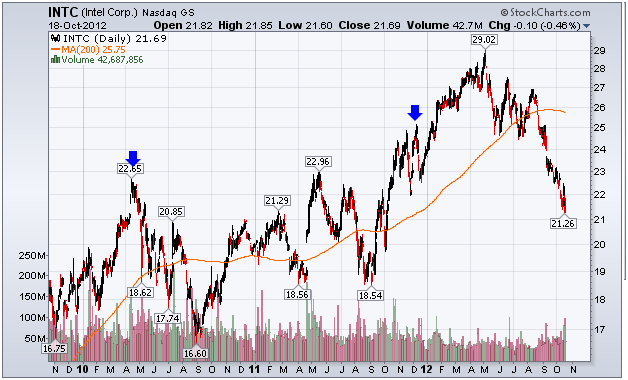

This chart shows the price of INTC shares along with an important gap to monitor.

Though INTC shares have taken a pounding this summer, I believe the worst is over.

Not only is the stock cheap, carrying a P/E ratio of nine and forward P/E of 10, the shares have dipped too far away from the 200-day moving average (orange line) without a proper back test. This type of price discrepancy often results in a countertrend move.

In 2010, INTC popped more than 15% above the 200-day moving average (first blue arrow). The shares proceeded to decline for the next six months and it took them more than a year to exceed that former peak.

Then in 2011, INTC exceeded the 200-day moving average by more than 17.5%. Though the stock continued to rise for the next several months, the shares ultimately moved below this high a year later. Currently, the shares are 14% below that high (second arrow).

It’s impossible to know how long, or at what level, INTC will bottom. But taking clues from the past indicates that investors should be buying the stock and sellers should cover any short positions.

Equities mentioned in this article: AAPL, INTC

Facebook

Facebook

Twitter

Twitter