The safer, more profitable strategy to invest in a developing trend is often the less direct strategy. By that I mean — don't automatically go for the obvious.

Take housing, for instance. The obvious strategy would be to invest in housing stocks or, as I wrote earlier this week, ETFs. And there are some solidly compelling choices – Toll Brother (NYSE: TOL) and Lennar Corporation (NYSE: LEN) come readily to mind.

To be sure, Toll Brothers and Lennar are fine home builders, but I think there's a better choice for income investors. If you’re an income investor, Toll Brothers and Lennar don't quite make the cut: Toll Brothers doesn't pay a dividend and Lennar pays a pittance.

I want to invest in the housing recovery, but I also want to invest for income and stability. There's an investment that does just that; plus, it provides a diversification benefit most stocks don't offer.

This “housing” company invests in both timber and land, which have a low correlation with other asset classes. What's more, this company pays a dividend that generates a generous 4.2% annualized yield.

I'm referring to Plum Creek Timber (NYSE: PCL), the nation's largest holder of timberland.

Plum Creek caught my attention back in December. It was subsequently added to the High Yield Wealth portfolio in January, and has generated a nice 10.7% return over the past seven months.

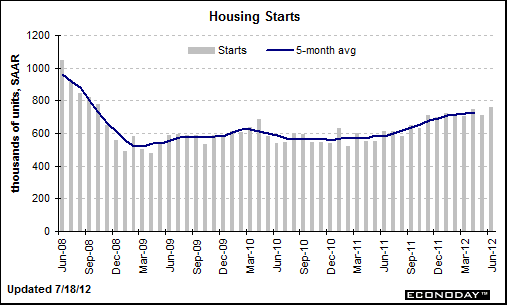

I think there is more upside. New-home construction is on the rise, and housing starts have been in a perceptible, persistent uptrend for the past year.

I don't see that trend reversing anytime soon. There's simply a dearth of new-home inventory. In June, there were 144,000 new homes for sale – the lowest on record dating back to 1963. At the current sales pace – 350,000 units annualized – it would take roughly 4.9 months to exhaust the June supply. A six-month supply is considered the norm.

At the same time, demand is rising, thanks to stabilized home prices and mortgage rates that are at their lowest in 60 years.

The trend in new-home construction is good news for Plum Creek. Timber demand and timber prices are closely tied to housing construction. An average new home contains more than 14,000 board feet of lumber.

Given the trend in new-home construction, I wasn't surprised to see Plum Creek report that revenue in its Northern and Southern operating regions – which are closely tied to tree harvesting – rose 27% and 25%, respectively, in the second-quarter of 2012 compared to 2011. The increase was driven by a 30% increase in sawlog harvest.

So obviously Plum Creek's fortunes are tied to the housing recovery, but not all its fortunes. You see, unlike the other large timber companies – Weyerhaeuser (NYSE: WY), Rayonier (NYSE: RYN), and Louisiana-Pacific (NYSE: LPX) – Plum Creek has only a small manufacturing operation. The high focus on timber and timberland makes Plum Creek the purest timber play of the bunch, and that offers additional benefits.

Although timber is considered a renewable resource, the world's timber supply is steadily shrinking, by an estimated 2.4% annually since the 1990s. Over the long term, this trend will make the remaining land and the timber that grows on it more valuable.

Timber is also analogous to a zero-coupon bond, in that investors must wait years for the investment to pay off. That said, timberland owners don't have to wait until the product matures. Therefore, timber has an imbedded option: harvesting (cash recognition) can be accelerated or decelerated according to market prices.

Cash recognition can be further accelerated through strategic land management. Many times the highest value land use isn't timber production. Timberland can be strategically sold for development when the development value is higher than the timber value.

Timberland owners also have the option to lease the land for other uses. Plum Creek has developed side businesses by leasing its land for oil and natural gas exploration, mineral extraction, wind power, and communication and transportation rights of way.

So, yes, Plum Creek is a solid price-appreciation investment tied to the housing recovery. But it's also a solid investment for income and for reducing portfolio risk through asset diversification.

Facebook

Facebook

Twitter

Twitter