In New York huge lots of commodities get traded every day on the COMEX (Commodity Exchange) between market makers, speculators, producers and consumers.

It can be very confusing – because we can’t know why banker X, trader Y, consumer Z or producer A buys, sells or holds at any given time. There’s lots of noise – and most investors simply will never buy or sell a commodity contract.

It’s somewhat complicated, but one easy way to get a reading on what’s really going on for a specific commodity is to see how many contracts are long, and how many are short.

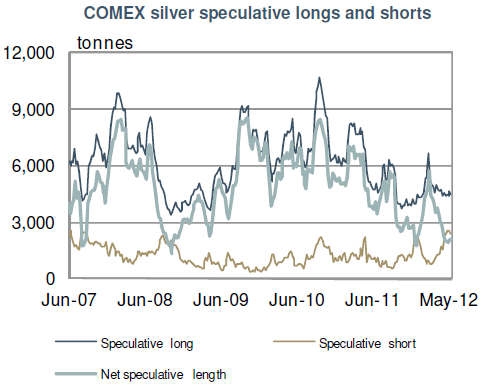

The chart below shows us that right now, on a net basis, there are more contracts short than at any time during the last two years.

How is this information useful? Well, think of the commodity market (or any market) as a boat. When everyone stands on one side of the boat, it’s generally a good idea to stand on the other side.

Put another way: when would you rather buy – when everyone else is bullish and buying, or when everyone else is bearish and selling?

And to support this analogy, just look at a price chart of silver plotted during the same 5-year period:

Each time the COMEX net positions were at this point, silver rose in the months following.

I know these kinds of charts seem cherry picked or uninformative, and I’m also acutely aware that I seem to tell you to buy silver every week.

And to be honest, had you bought every time I told you to buy silver, you’d be sitting on substantial gains considering your average cost basis.

If you’ve been averaging into your position steadily over the past few years (as I have) then you’re doing it right.

But if you’ve been slacking lately because of all the volatility and perceived uncertainty in the markets – or if you’ve NEVER bought silver – then right now is about as good as it gets to pull the trigger.

As you may know, I recently bought silver at about the same price it sells for today. I think it’s a fine time to build or add to your position – and my long-term prediction is STILL for silver to top out at over $100 an ounce before the end of this current commodity bull market.

When will this bull market end? I can’t say, but I firmly believe we have several years left at the very least.

And if you’re interested in finding out more about the best ways to profit from this commodity bull market, then I think you owe it to yourself to check out a free event that my colleague Tyler Laundon is hosting this Thursday at 7 p.m. EST.

Tyler recently celebrated a 500% gain in his latest oil stock recommendation – and he’s going to discuss exactly how he finds commodity profits in his free event. Click here to get signed up now.

Facebook

Facebook

Twitter

Twitter