There's no question about it! Natural gas is stunningly cheap right now.

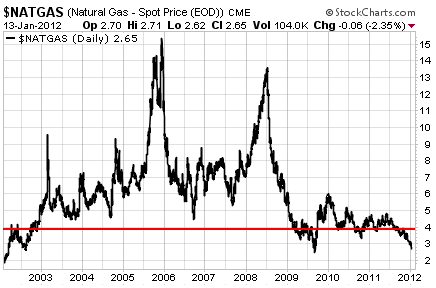

I've written many times over the past couple years about cheap natural gas. I usually wait until it's at or under $4 per MMBTU (million British thermal units).

Until recently, $4 per MMBTU was a pretty cheap long-term price.

But lately natural gas prices have fallen off a cliff.

Today, the price of natural gas is as low as it's been since the middle of 2009 – at the height of the recession.

So, it's a great time to buy natural gas right? Sure. if you have a bunch of storage tanks. The problem is, there's really no great way to give your portfolio leverage to higher natural gas prices right now.

Most investors will probably look for a natural gas ETF to try to get quick and easy access to the trend.

If you do a quick google search, the first ETF to come up will likely be the United States Natural Gas Fund (NYSE: UNG).

But UNG is a terrible way to invest in natural gas. It outpaces natural gas losses on the downside and can't keep up when prices rise. Just avoid it.

There are some companies that appear fairly valued right now in the natural gas space – but lower prices will cut into the margins. I'm concerned that all of the hoopla about lower natural gas prices will convince a whole crop of investors to pile into the sector over the short term, only to drop them a few weeks or months later.

Most of the domestic natural gas companies are too richly valued for my taste – for instance, Cabot Oil and Gas (NYSE: COG) operates natural gas wells throughout the United States. They currently sell for nearly 50 times earnings.

Or one of the biggest domestic natural gas companies, operating out of the Bakken region: EOG Resources (NYSE: EOG) – they sell for 26 times earnings.

What do you think will happen to these companies' earnings when they have to sell natural gas for $2.50 per MMBTU rather than $4.80 – (the price they were getting this time last year)?

I think we'll see some great opportunities in natural gas soon – but only when natural gas companies catch up (or rather, down) with natural gas prices.

Be patient. We'll see some screaming deals in natural gas before too long.

Good investing,

Kevin McElroy

Editor

Resource Prospector

Facebook

Facebook  Twitter

Twitter