- Don’t forget about this….

-

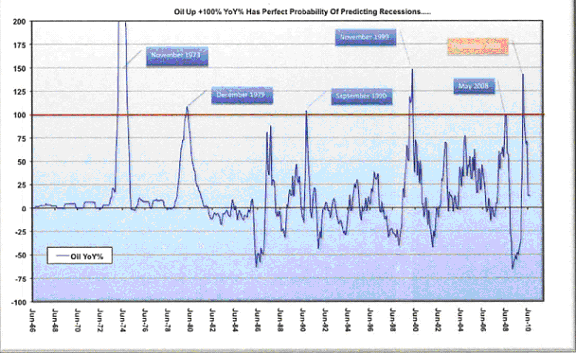

12 months of recession if this commodity sees its

shadow - My theory about oil

The most important thing for your investments isn’t gold or

the dollar, or the consumer price index or Treasuries or even the stock

market.

It’s energy. More

specifically, it’s crude oil. Oil absolutely dwarfs everything else.

As I wrote back on June 3:

“…in

April of this year, a new daily volume record was set on the Intercontinental

Exchange (ICE) for West Texas Intermediate Crude (WTIC) contracts – with an

astounding mark of 464,381 contracts traded in just that one day. Each

contract trades 1,000 barrels of oil.

With oil prices around $84 that day, each contract was

worth about $84,000. So, it means that over $38 billion worth of oil contracts traded hands in that one day

alone.

Granted, that was the daily record, but the WTIC futures

regularly bypass the $30 billion mark on an average day. To put it in

perspective, $38 billion is more than the annual earnings of Wal-Mart

(NYSE: WMT), the world’s largest

corporation.

Furthermore, WTIC is just one type of crude oil, traded

on just one futures market. There are at least a half-dozen other crude oil

contracts in a handful of different futures exchanges.”

So you ignore crude oil at the peril of your entire

portfolio. While President Obama and Congress bicker over the crumbs of the

economy, and the mainstream media frets over jobs, the recovery,

inflation/deflation, and Wall Street pumps out a new ETF every week –

practically no one is ringing the warning bell about what’s going on with

oil.

Sure, the BP (NYSE: BP) spill was in the

news for months, but no one in the press took the opportunity to bring the

much larger issue of where/when and how this nation will fare in the coming

months and years as regarding our access to oil, or even gave a token nod to

the fact that the price of oil has more than doubled over the past 12

months.

Okay, so not everyone has been asleep at the wheel.

I found this

interesting chart via the Pragmatic

Capitalism website, and it’s originally from the Global Macro Investor

site.

This chart basically shows how a doubling in oil prices has

always (so far) predicted a recession for the following 12 month

period.

It predicted the recessions of 1974, 1980, 1999, 2008, and

now it’s predicting another recession for 2010.

Okay, I’m not a technical analyst by any stretch of the

imagination, so I’m really not interested so much in the idea that this

“chart” predicts a recession, so much as I am interested in why it does so

for fundamental reasons.

So far, I’m not exactly sure why this indicator has been so

accurate – but I have a few theories.

I’d also like to hear yours – send them along to editorial@resourceprospector.com.

Of course a recession by definition is backwards looking.

The standard definition of a recession is when productivity (GDP) falls for

two straight quarters. You can’t really know if productivity has fallen until

after the fact, since the government and other market measuring bodies do not

yet have crystal balls or time machines.

My main theory (which I’ll focus on today)

ties in directly with my opening statement: oil rules. So if the most

important commodity, asset, widget and product for world productivity doubles

in a year-over-year capacity, it probably means that it’s gone too far, too

fast and that the world’s producers are not able to produce as much.

Oil is the main input for almost any productivity equation,

whether we like it or not. So if it doubles in price, it means that

everyone’s productivity result has to diminish by some factor, depending on

how much the price of oil hits the bottom line. Industries that are highly

oil intensive (like shipping) will get hit worse than less energy intensive

industries like, say, telecoms or healthcare.

There are exceptions – and it might be that these

exceptional industries, that are off the teat of oil will be the ones to

thrive during the death throes of peak oil – but right now I’m more

interested in what we can expect on a macro level.

I’ll be going into some specific investment ideas in

tomorrow’s issue – but if I can leave you with one thing to keep in mind,

it’s to remember the importance of oil – even for non-commodity investments.

You need to look at all of your investments, from stocks even down to bonds

and savings accounts, and think about how oil price fluctuations could affect

the bottom line of the underlying assets and businesses you’re invested

in.

Good investing,

Kevin McElroy

Editor

Resource Prospector

disclosure: no positions in BP

Facebook

Facebook

Twitter

Twitter